By Jaston Binala.

Tanzania’s economy is in deep recession based on open data from Bank of Tanzania and the World Bank–and the brunt of the recession is being felt by business.

Three business owners who can not be identified as requested tell TZ Business News parastatal banks especially display signs of serious liquidity trouble. A businessman in the logistics and transportation industry says he knows colleagues who have asked for credit from banks–the banks accept the request but no loan disbursement comes out and they do not say why.

Another businessman, this one in construction and real estates tells TZ Business News he fulfilled all the loan requirements at a parastatal bank in October 2020 but no disbursement of credit has been effected up to this moment– ten months later. A similar story is shared by an SME operator who has asked for less than Tsh. 5,000,000/- credit from a parastatal bank.

The best advice business people give to one another in need of credit directs you to foreign banks– especially Kenya Commercial Bank (KCB) praised as an excellent source of business credit.

Open data by the World Bank and Bank of Tanzania (BoT) present a carefully camouflaged deep recession in Tanzania associated with a serious lack of credit in the economy.

During the fourth quarter of 2020, BoT reported Tanzania’s headline inflation “continued to be subdued, averaging 3.2 percent in the third quarter of 2020, compared with 3.6 percent in the preceding quarter and 3.5 percent in the corresponding quarter in 2019”. The Central bank explains that this low inflation was driven by subdued prices of food and non-food consumer goods and services.

The Central Bank says prices of petroleum products contributed significantly to moderation in non-food inflation. The inflation outturn was below the country target of 5 percent, and was in line with the EAC and SADC convergence benchmarks, and that inflation in the EAC averaged 5.8 percent and in SADC it was 5.4 percent. Using the EAC inflation as benchmark Tanzania’s inflation rate was around 45% “negative” in both 2019 and 2020. Negative inflation signals a serious shortage of credit in the economy.

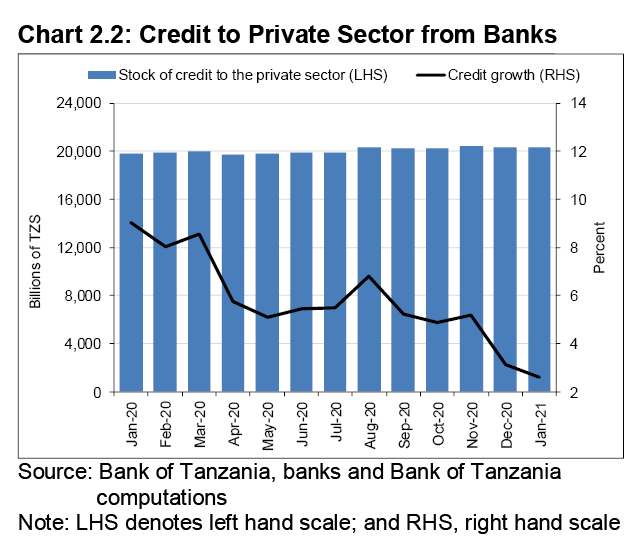

In January 2021 Tanzania businesses started the year with almost no access to credit as shown in the Bank of Tanzania chart above. But the Central Bank carefully choreographed that story to make it appear like the private sector had access to credit at the start of 2021.

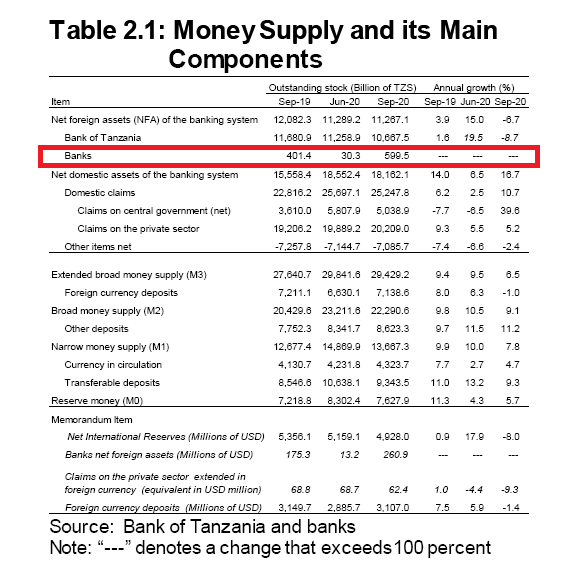

The Bank of Tanzania January 2021 Economic Review document reports as follows: “Growth of money supply continued to improve, as the Bank of Tanzania sustained implementation of monetary policy easing to facilitate economic activities and private sector credit growth.

“Extended broad money supply (M3) grew by 6.4 percent in the year ending January 2021 compared with 5.7 percent and 9.1 percent in December 2020 and January 2020, respectively. Broad money supply (M2), grew by 7.7 percent compared to 8.2 percent and 11.4 percent.

“Credit extended by banks to the central government and private sector grew at an annual rate of 6.2 percent in January 2021 compared with 10.8 percent in December 2020 and 6.6 percent in January 2020.” BoT reports without explaining why the central Government is joined with the private sector in that 6.2 per cent credit growth.

Good analysis would indicate, nonetheless, that the joint 6.2% growth rate above should, when compared to 10.8% and 6.6% earlier be explained as a shrinkage of credit in 2021—not a growth.

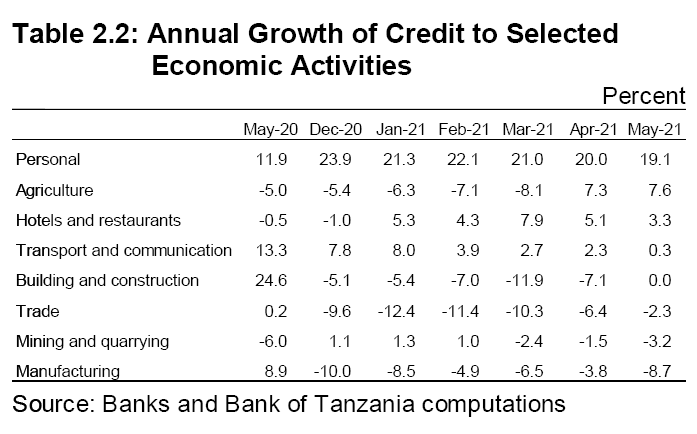

BoT reported in the January 2021 economic review that credit from banks to the central government was effected through purchase of government securities, adding that the credit rose by 24.6 percent. Credit extended to the private sector rose by TZS 513.8 billion, translating into an annual growth rate of 2.6 percent compared to 3.1 percent in December 2020. BoT thus shows in 2021 credit priority was given to the Central Government at the expense of the private sector. The June 2021 the BoT Enomic Review confirms a credit crunch in a number of key sectors of the economy as only a small section of the economy is financially enabled.

Manufacturing, mining and quarrying, Trade, building and construction and agriculture were starved as shown above. Credit trickled mainly to individuals, hotels and restaurants, and the transport and communications sector the first half of 2021.

Banks provide credit from deposits. Under the prevailing economic conditions it doesn’t appear likely that banks receive sufficient deposits to sustain lending. Unfortunately, BoT does not expose individual deposits and liquidity levels—a position which should be understood because exposure would carry with it the risk of sparking a ‘bank run’.

In open societies, however, Governments bail out troubled banks to protect economies, to protect jobs, to protect livelihoods which rely of entrepreneurship.

The World Bank has in the meantime described the current state of the Tanzania economy as ‘dire’. Tanzania has fared relatively well compared to its regional peers, the Bank says in a report updated three months ago.

“But economic growth has slowed significantly. The real Gross Domestic Product (GDP) growth rate fell from 5.8% in 2019 to an estimated 2.0% in 2020, and per capital growth turned negative for the first time in more than 25 years,” the World Bank says in its current analysis of the Tanzania economy.

That drop of Tanzania’s GDP represents a staggering 66% fall between 2019 and 2020. Economists regard an economy to be in a depression if GDP drops by over 10%.

Steep declines in production, consumption, and imports have significantly reduced fiscal revenue. The [Covid-19] pandemic has also compounded pre-existing challenges in the financial sector, and the share of non-performing loans on bank balance sheets continues to be high, while the growth of credit to the private sector has slowed, the World Banks says.

Tanzania’s rapid population growth has caused the number of people living below the national poverty line to steadily increase.

In 2020, the pandemic-induced economic slowdown caused the poverty rate to rise to an estimated 27.2%, compounding the effect of population growth on the absolute number of people living in poverty.

Because a large share of Tanzania’s population is close to the poverty line, even a mild economic shock can push numerous households into poverty. The impact of the crisis has been especially acute among households that rely on self-employment and informal microenterprises in urban areas, the Bank has said.