By TZBN Staff and Agencies.

The international tax formulation system currently controlled by the global-north-led Economic Co-operation and Development Organization (OECD) is about ‘to change hands’. The process for system transfer to the United Nations has started.

Countries of the global south have complained for years the OECD formed by rich nations over 60 years ago, has since its formation created an unfair international taxation system which favors the rich global north. The OECD is now about to lose its international tax formulation powers.

A landslide endorsement of a resolution to change the old taxation status quo sailed through at the UN between August and November 2023. The UN Resolution titled “Promotion of Inclusive and Effective International Tax Co-operation at the United Nations” has set the stage for disbanding of the OECD framework which has been used by rich nations to formulate unfair international taxes for years in favor of the rich north.

Tax Justice Network (TJN), the international non-governmental organization which advocates for fairness in the international taxation system, has described the passing at the UN of the resolution as “a historic victory delivered by countries of the global South, for the benefit of people all around the world”.

“Today, we start to take back power over global tax rules that affect all of us,” said Alex Cobham, Chief executive at the Tax Justice Network in a statement. “The result of today’s UN vote has for decades been considered impossible to achieve. The last attempt to bring decision-making on tax rules to the UN was in the 1970’s. The failure of the attempt dissuaded any similar attempts for nearly 50 years.”

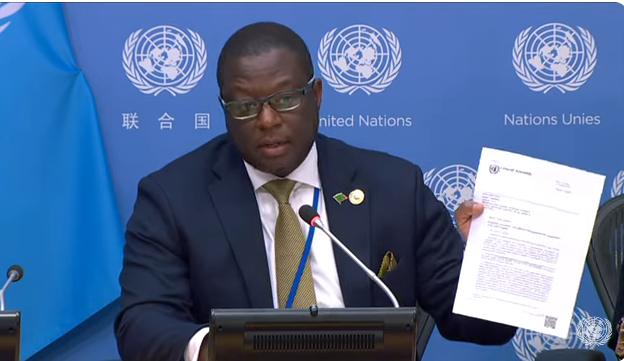

The Africa group at the UN, led by His Excellency Ambassador Dr. Chola Milambo, Permanent Representative at Permanent Mission of the Republic of Zambia, spearheaded the diplomatic campaigns to achieve the historic landslide passing of the resolution. All African countries voted in favor of this resolution to eventually remove powers to create the international tax system away from the OECD, and to place those powers under custody of the United Nations.

Giving a press briefing before the vote, Dr Milambo said the world needed a more fair, equitable and inclusive tax system that moved decision-making powers on matters of tax away from the OECD to the United Nations.

A TJN Statement read in December 2023: The past year, and these last few weeks before the vote especially, saw strong opposition to today’s resolution from the OECD and from OECD members the US, UK and EU as well.

The UK and EU in particular drew criticism in recent weeks from negotiators at the UN for attempting to “kill” the UN process and for negotiating in “bad faith”.

The success of the resolution despite the resistance from the world’s strongest economies is a rare feat, and demonstrates the overwhelming demand from countries outside the OECD for the meaningful voice on global tax rules which they have historically been denied.

A last-minute attempt by the UK to defang the UN resolution, by removing any mention of a convention from the resolution, was defeated by nearly 2 to 1: 107 countries rejected the resolution; 55 countries supported it. The unamended resolution was supported by an even bigger margin. Nearly two-thirds (125) of countries at the UN voted in favour of the reforms. 48 countries voted against the resolution and 9 abstained. The US, UK and all EU member countries voted against the resolution.

The adoption of the resolution is being widely celebrated by government officials, economists and civil society organisations around the world. The African Union published a statement shortly after the vote saying: “The decades’ long fight of Global South countries to establish a fully inclusive process at the United Nations to participate in agenda setting and norm setting on international tax is now a reality.

“We look forward to building on this spirit of cooperation and agreeing on an effective UN Framework Convention on International Tax Cooperation to urgently mobilise resources for our development.”

Alex Cobham, chief executive at the Tax Justice Network said “This is a historic victory delivered by the countries of the global South, for the benefit of people all around the world. Tax havens and corporate lobbyists have had too much influence on global tax policy at the OECD for too long. Today, we start to take back power over the global tax rules that affect all of us. The great majority of countries have declared today that they are ready to move on from the OECD, and will start negotiating global tax rules at the UN instead.”

The achievement at the UN is actually culmination of activities which have taken place in various places for many years–including a resolution passed at the Helsinki, Finland conference titled ‘Transparency’s tipping point’ in 2017.

Telita Snyckers of TJN, an international tax administration policy specialist has said of the UN vote: The success of the resolution despite the resistance from the world’s strongest economies is a rare feat, and demonstrates the overwhelming demand from countries outside the OECD for the meaningful voice on global tax rules which they have historically been denied,

While this vote was the focus of collective advocacy, important groundwork was also happening elsewhere, she said. “Our team members were heavily engaged in the Latin America Summit in Cartagena (working closely both with Ministerial officials in the region, civil society, and UN human rights officials) using Tax Justice Network tools and data to press home the importance of the shift of tax governance to the United Nations.

“A specific outcome of the Cartagena Summit was the establishment of a Platform on Tax which is chaired by the Colombian Government; and an invitation to join a dialogue with the Chilean Minister of Foreign Affairs, the UN High Commissioner on Human Rights, the UN office coordinator in Chile and the new member of the Committee on Economic, Social and Cultural Rights with a view to keeping the momentum going on truly securing global tax policy development.

“The vote marked a turning point, and sets us on an exciting new course in 2024 and beyond, in pursuit of tax justice!”