By TZBN Staff.

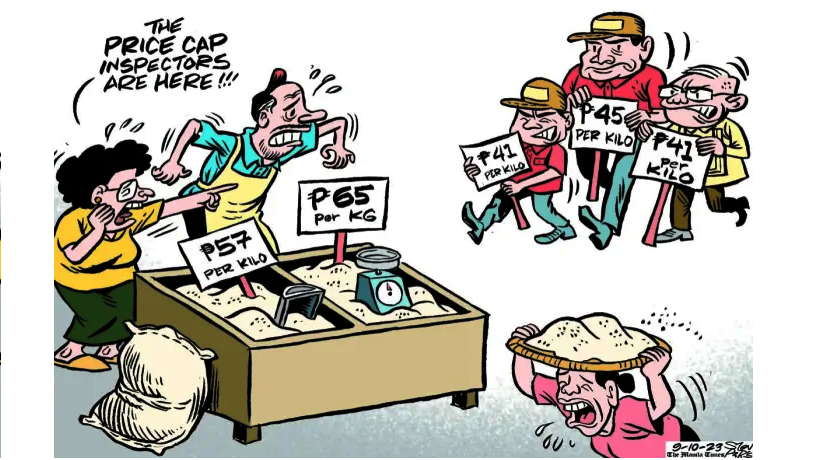

Tanzania’s year 2023 economic environment was in reality quite hostile to business expansion and prosperity. Petroleum products vendors probably remember price caps on petrol, diesel and kerosene. Price caps are not a very good idea from a businessman’s point of view. They create discomfort in your business.

But price caps were not the only menace creating discomfort in business last year. The Central Bank was also busy monkeying with treasury bond yields to attract money away from lending to the private sector. You might recall one such effort in July 2023 when the Bank of Tanzania (BoT) created conditions to increase bond yields by a couple of percentage points; around 0.36 percentage points to be precise.

The Central Bank is continuing to monkey with bond yields even now as we speak to woo money away from lending to the private sector by making bond yields better—which in effect encourages banks to buy bonds instead of lending to private sector.

What that type of policy does to the private sector is that it makes it kind of less attractive to lenders like banks– because the private sector cannot offer better interest rates, better returns on investment, in comparison to Government bonds. The outcome then becomes less money for business expansion, less money for business development less money for all kinds of business activity, less employment.

Out there in the streets–in the real world–a shish kebab seller sets up his charcoal burner to roast meat but he can not finish selling five kilos of beef as he could do in the past because there are now less customers, less buyers. People have very little money to spend. This leads the shish kebab seller into a loud-thinking bust “hela imeenda wapi?” (Translation: where has the money gone to?).

Well, the money has gone back to the central bank because the Central Bank has reversed its 2021 monetary policy stance – fortunately, however, it’s for a good reason. It turns out what happened to the Tanzania economy in 2023 may have been a lesser evil. And something else, too, in the final analysis, it turns out the private sector braved this lesser evil. If some instinct is pushing you to applaud the Tanzania private sector please go ahead and clap. The situation would have been worse if inflation were to be allowed to rise too high.

Like other nations in the currently highly connected ‘global village’, what happens elsewhere in the world affects everybody around the world, including the shish kebab seller on the street here. In a recent Bank of Tanzania Monetary Policy Committe (MPC) Statement, the Central Bank alluded that external events had threatened to push inflation to unacceptable levels, forcing adoption of this ‘unaccommodating monetary policy’ intervention.

The MPC discussed the global economic outlook and noted that the situation had been relatively weak for most of 2023, largely due to geo-political tensions, tightened financial conditions across the globe, and high energy prices. The condition might improve in 2024, conditional on the fading of geo-political conflicts, decline in energy prices in the world market, and easing of monetary policy tightening in advanced economies.

The BoT has not made its intentions secret. It is squeezing money out of the economy on purpose to tame inflation. On 19 December 2023 BoT’s Monetary Policy Committee (MPC) said in a Statement: Owing to implementation of [the on-going] less accommodating monetary policy, the growth of monetary aggregates slowed in November 2023.

“Extended broad money supply grew at 13.7 percent compared with 14.5 percent recorded in September 2023, driven by private sector credit growth, which slowed to 18.3 percent from 19.5 percent.

“Inflationary pressures remained muted, evolving below the target of 5 percent, owing to the smooth coordination of monetary, fiscal, and structural policies. As a result, the downward trend of inflation observed since the beginning of 2023 continued, reaching 3.2 percent in October and November 2023 from 3.3 percent which persisted for three months consecutively, primarily driven by moderation in food prices.

Talk about price caps!

The Statement explained: “The Monetary Policy Committee (MPC) met on 18th December 2023, to review the conduct of monetary policy and performance of the economy. During deliberations, the MPC observed that the less accommodative monetary policy continued to keep monetary and financial conditions at the level required to contain inflation below the target of 5 percent [while continuing] to support economic activities and financial sector stability. Also, supported by fiscal policy and an improvement in proceeds from exports and tourism, the policy stance lessened the pressure on demand for foreign currency in October and November 2023.”

What stands out best, though, from the MPC statement–from a private sector standpoint are figures which show Tanzania businesses performed pretty well under those rather difficult conditions in 2023– and the Bank of Tanzania acknowledges this to be true. Non performing loans in the banking sector dropped from 7.2% in 2022, down to 5.3% last year, while the 2023 quaterly GDP growth rate showed only a slight drop between Q1 and Q2.

“Despite the spillover effects of the global shocks, the performance of the economy was satisfactory in 2023 and is expected to further improve in the subsequent year, on account of the implementation of growth-enhancing policies and increased private sector investment,” the MPC statement said. “Specifically, growth in the first and second quarters of 2023 was 5.4 percent and 5.2 percent, respectively, bolstered by the diversified nature of economic activities.

Talk about a resilient private sector!

“Given this performance, combined with leading economic indicators for the second half of the year, growth outturn for the entire year [2023] might be above the projection of 5 percent,” the MPC statement says.

The Bank predicts the easing of conditions in 2024, but analysts will probably agree it is not easy to predict when this projected easing will be realized– which means last year’s ‘unaccommodating monetary policy’ is likely to be around for some time.