By TZ Business News Staff.

Dar es Salaam Stock Exchange (DSE) recorded a total turnover of Tsh. 1,309.08 million from 221,725 shares traded in 84 deals on Wednesday, January 7, 2015 compared to the previous session which recorded a turnover of Tsh 106.38 mln from 112,123 shares traded in 66 deals. The exchange is getting ‘bullish’ as time passes.

The CRDB counter had 108,920 shares traded at weighted average price of Tsh. 430 per share in 32 deals. NMB counter had 9,279 shares traded at weighted average price of Tsh. 3,480 per share in 14 deals, the daily stock market report has said. The TBL counter had 83,100 shares traded at weighted average eprice of Tsh. 14,480 per share in 20 deals. SIMBA counter had 160 shares traded at weighted average price of Tsh. 4,000 per share in 1 deal.

TPCC counter had 1,908 shares traded at a weighted average price of Tsh. 4,000 per share in 6 deals while the TCC counter had 300 shares traded at a weighted average price of TZS 16,000 per share in 3 deals. DCB counter had 17,378 shares traded at weighted average price of TZS 730 per share in 6 deals. SWALA counter had 680 shares traded at weighted average price of TZS 700 per share in 2 deals.

THE EARLIER STORY

The Dar es Salaam Stock Exchange finally awoke from an after-Christmas slumber. Although still ‘bearish’ when compared to pre-Christmas trading last year, stock market trading activity has made an upward movement in the second week after the Christmas holidays.

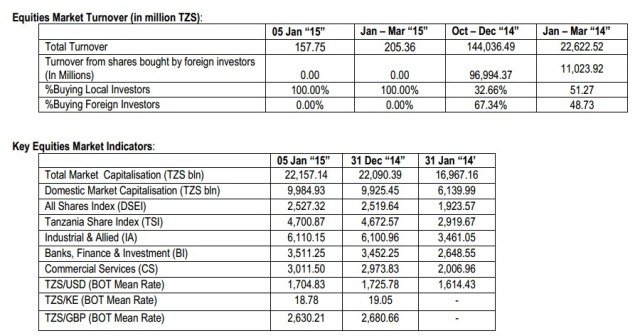

DSE recorded a total turnover of TSH. 157.75 million from 161,696 shares traded in 65 deals during the trading on Monday, January 5, 2014, which compares to the previous session which recorded a turnover of TSH. 47.61 million from 33,746 shares traded in 54 deals. DSE records show the October –December 2014 equities market turnover stood at Tsh. 144 billion.

On the Government Bond Market Board, in the meantime, one five year bond with 9.18% coupon rate and face values of TSH. 2.7 billion was transacted at a price of 77.6190% in 2 deals on Modanday as the market awoke from its slumber. The Dar es Salaam Stock Exchange is East Africa’s best performing bourse.

The DSE market report for Monday, January 5, 2015 says the CRDB counter had 129,966 shares traded at weighted average price of TSH. 435 per share in 19 deals. NMB counter had 16,000 shares traded at weighted average price of TSH. 3,470 per share in 21 deals. TBL counter had 2,100 shares traded at weighted average price of TSH. 14,430 per share in 7 deals.

SIMBA counter had 330 shares traded at weighted average price of TSH. 4,250 per share in 1 deal. TPCC counter had 40 shares traded at weighted average price of TSH. 4,000 per share in 5 deals. TCC counter had 300 shares traded at weighted average price of TSH. 16,000 per share in 4 deals. TCC share price had continued to slide downward in the Monday trading after an earlier fall the first week of January, when the prices had dropped from Tsh. 16,740 per share down in the earlier trading to Tsh. 16,300/- per share in the first week of January.

SWALA counter had 12,510 shares traded at weighted average price of TSH. 700 per share in 5 deals. DCB counter had 450 shares traded at weighted average price of TSH. 720 per share in 3 deals.

On Tuesday 6th January 2015, DSE recorded a total turnover of TSH. 106.38 million from 112,123 shares traded in 66 deals compared to the previous session which recorded a turnover of TSH. 157.75 million from 161,696 shares traded in 65 deals.

The Government Bond Market Board, one two year bond with 7.82% coupon rate and face values of TSH. 2.1 billion was transacted at a price of 95.1477% in 1 deal.

CRDB counter had 85,965 shares traded at weighted average price of TSH. 430 per share in 31 deals. NMB counter had 3,298 shares traded at weighted average price of TSH. 3,460 per share in 17 deals. TBL counter had 930 shares traded at weighted average price of TSH. 14,450 per share in 6 deals. SIMBA counter had 5,000 shares traded at weighted average price of TSH. 4,250 per share in 2 deals.

The TPCC counter had 1,500 shares traded at weighted average price of TSH. 4,000 per share in 1 deal. TCC counter had 250 shares traded at weighted average price of TSH. 16,500 per share in 1 deal. DCB counter had 14,700 shares traded at weighted average price of TSH. 725 per share in 4 deals. SWISSPORT counter had 480 shares traded at weighted average price of TSH. 5,000 per share in 4 deals. Equities Market Turnover (in million TSH.):

The Dar es Salaam Stock Exchange was the best performing bourse in East Africa during the first nine months of 2014 after investors nearly doubled their wealth, beating their counterparts who put money into the Nairobi, Kampala or Kigali securities markets, according to the upmarket regional publication,The East African.

Data from the four stock exchanges shows the worth of investor companies on the Dar es Salaam bourse — as measured by market capitalisation — rose by 84.32 per cent as at the close of trading last Tuesday.

DSE is second in size after the Nairobi Securities Exchange but the value of its 13 locally listed companies stood at Tsh11.02 trillion ($6.6 billion) as at the end of September this year, up from Tsh5.97 trillion ($3.79 billion) as at December 31 last year, making it the best performing in the region.

The stellar performance is attributed to a general increased interest by investors, adoption of technology by the stock exchange and Swala Energy’s listing in August, which became DSE’s best performing stock during the first nine months of this year.

“Investors’ positive outlook on the Tanzania economic growth story, the bullish investors’ sentiment in the companies listed on the Exchange and the Exchange itself as well as our efforts to increase our operations efficiencies especially the infrastructure and rules has contributed,” said Moremi Marwa, chief executive officer, DSE.

Last year, the Dar es Salaam bourse migrated to a wide area network (WAN) making it easier for brokers to access trading and central securities depository infrastructure while extending trading hours.

The upgraded system has made trading more convenient and as a result the level of activity has gone up.

The DSE also has six Kenyan-based companies and another mining company whose primary listing is the London Stock Exchange cross-listed on it.

Swala Energy’s share price more than doubled to close at Tsh1,160 ($0.70) as at September 30 from its listing price of Tsh500 ($0.32).

Shares of Tanzania Breweries Ltd, cement maker Simba Cement, also known as Tanga Cement Company, and Tanzania Cigarette Company also more than doubled in price while National Microfinance Bank shares rose by 67.56 per cent earning a place in the list of the top 20 gainers of the region.

Mr Marwa said that continued economic growth particularly in sectors such as infrastructure, energy, construction, telecommunication and financial services, an increase in listed companies, ongoing reforms in the pension space resulting in new products targeted at pension funds are factors expected to have a positive effect on the bourse in coming days.

The NSE, which contributed 14 of the top 20 gainers, came in second with a 19.54 per cent increase in investor wealth which stood at Ksh2.29 trillion ($25.71 billion) as at the close of the third quarter up from Ksh1.92 trillion ($22.25 billion) as at the close of trading on December 31 last year.