By TZBN Staff

The Bank of Tanzania (BoT) has revitalized a 2007 de-dollarization policy in the country as it struggles to deal with a serious shortage of the green buck. The financial regulator has repeated its ban on the use of foreign currencies—especially the US dollar for all local transaction – except for a limited number of transactions it names.

A financial analyst based in Port Louis, Mauritius, Gerald Ndosi, suggests through observations this BoT move is a positive action a country could take to manage forex shortage. The Analyst is Head of Trade at Bank One in Mauritius.

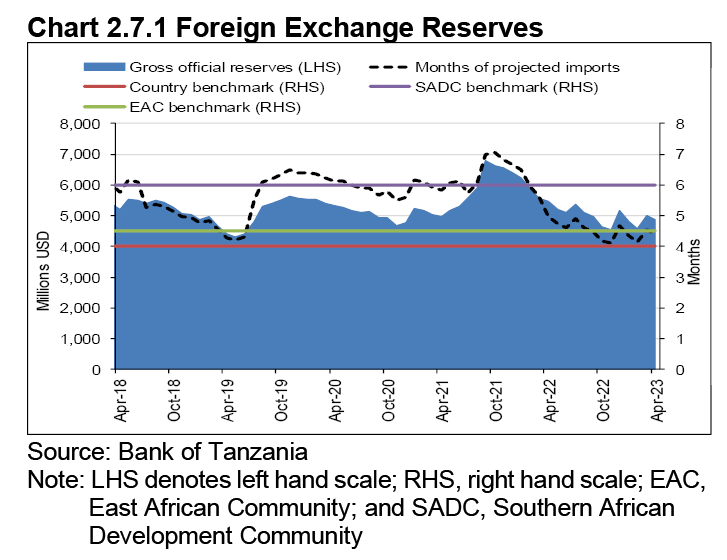

Director of Economic research and Policy at the Bank of Tanzania Suleiman Misango recently admitted there is a foreign exchange shortage in Tanzania caused by external factors beyond the country’s control. He added, however, that current foreign exchange reserves are deemed adequate to cover approximately 4.4 months’ worth of imports, which meets the country’s benchmark requirement.

But a central bank Economic bulletin issued in May indicates the forex reserves at slightly above USD 4.5 billion fall considerably short of the Southern African Development Community (SADC) benchmark at USD 6 billion. Tanzania is a SADC member country. The East African Community benchmark is around USD 4.5 billion. Tanzania had set its ‘personal’ benchmark at only USD 4 billion in May 2023.

Ndosi lists Tanzania among Sub-Saharan countries dealing with a forex shortage: “Over the last year, most countries in sub-Saharan Africa (SSA) have experienced shortages of US dollars”, he says. “Every African country has felt the impact – however the problem seems to be more severe in economies such as Kenya, Tanzania, Egypt, Zimbabwe, Nigeria, Ghana, and Zambia that rely on the US currency to pay off their foreign debts and fund critical imports of goods and services”.

Ndosi suggests one way to deal with this problem could be to start settling payments in ‘Alternative Currencies’: India and China are the biggest trading partners with most of sub-Saharan African countries and recently, the Indian Central Bank (RBI) has allowed 18 countries, including 6 countries in SSA (Kenya, Tanzania, Seychelles, Mauritius, Botswana, and Uganda) to settle their international trade transactions in rupees. This initiative will help in reducing demand pressure on the US dollar by providing an alternative currency for settlement of international trade transactions.

The Bank of Tanzania statement issued by Governor Emmanuel Tutuba prohibits domestic payments for goods and services using foreign currencies between residents of the United Republic of Tanzania. The statement concludes with a soft-worded warning: “Section 26 of the Bank of Tanzania Act 2006 stipulates that the Tanzanian shilling is the only legal tender in the country. Thefore, any act of refusing payment in Tanzanian shilling amounts to violation of the Bank of Tanzania Act 2006”.

In August 2007 and December 2017, the Government issued a public notice prohibiting domestic payments for goods and services using foreign currencies between residents of the United Republic of Tanzania.

“However, the Bank of Tanzania has recently observed violations of the directives,” the Governor has said. “Therefore, the Bank of Tanzania would like to remind the general public that the Government’s directives issued are still valid and should be adhered to at all times as follows:

“All prices of goods and services in Tanzania should be quoted in Tanzanian shillings. These pertain to rent for land, housing and office; fees for education; medical services, equipment and reagents; transport, logistic and port services; electronic equipment and telecommunication services; etc.

“Prices to be paid by tourists or non-resident customers may be quoted and paid in foreign currency. These include services such as accommodation, travel, airport and visa, transit trade and cargo handling. Tourists and non-residents who pay in foreign currencies must provide their identification documents such as passport and certificate of incorporation for companies for proper capturing and classification of statistics.

“The exchange rate which will be used for making payment therein above should be displayed and should not exceed the prevailing market exchange rate. It should be noted that institutions registered to determine exchange rates are commercial banks and bureaux de change only.

“Any resident of the United Republic of Tanzania should use only Tanzanian shillings and not be forced or obliged to make payment to another resident of the United Republic of Tanzania for any good or service in foreign currency”.

Ndosi, the Head of Trade at Bank One in Mauritius offered advice to countries in Sub-Saharan Africa on how to deal with the problem of forex shortage. He offered the advice to promote trade finance, and foster sustainable economic growth in the region.

International Trade is conducted in the currencies of major economic powers, largely the US dollar, European Union Euro, Japanese Yen, Chinese Yuan, and UK Pound Sterling. Thus, these currencies clearly have a major impact on how trade is conducted across borders globally, including on the African continent, he says. A foreign currency shortage occurs when the demand for the currency exceeds the available supply at the prevailing exchange rate.

The shortage of the US dollar in key economies in SSA has meant liquidity challenges that can impact trade finance and affect the overall pace of economic activities in the region.

CAUSES OF SHORTAGE

Firstly, commodity dependence can affect the volume of dollars available in African markets, as many countries in SSA heavily rely on commodity exports, such as crude oil, minerals, and agricultural products. Fluctuations in commodity prices, which are often denominated in US dollars, can lead to revenue volatility, and affect the availability of US dollars in the local markets.

Secondly, limited export diversification means that the concentration of exports in a few commodities or markets can limit foreign exchange earnings in US dollars. The lack of export diversification makes economies vulnerable to external shocks and reduces the inflow of US dollars, affecting liquidity in the local markets.

Thirdly, high import dependence, which implies that sub-Saharan African countries often rely on imports for various goods and services – including essentials like food and fuel, can translate to a shortage of dollars as well. The need to pay for imports in US dollars puts pressure on their demand, especially when local currencies depreciate, or foreign exchange reserves are insufficient.

Economic sanctions imposed by Western countries on Russia, including restrictions on its energy sector has contributed for the bulk of global oil price hikes over the last year, thus fuelling pressure on oil importing countries to source more dollars for import bill settlement.

Fourthly, capital outflows and debt servicing burdens can translate into a dollar drain, with SSA having experienced an exodus of capital due to factors like global economic conditions, changes in investor sentiment, and policy uncertainties, the servicing external debt obligations in US dollars can further strain dollar liquidity in the region.

Finally, limited access to international financial markets can compound the problem, as it means that some countries in SSA face challenges in accessing international financial markets and raising funds in US dollars. Limited access to international capital markets restricts their ability to address dollar liquidity shortages through external borrowing.

How can African economies overcome these challenges and promote trade finance?

Addressing these pressing challenges arising from the prevailing US dollar shortage and ensuring sustainable trade finance requires a mixed approach, putting into play multiple strategies such as:

1. Economic Diversification, Export Promotion and Value Addition: Encouraging diversification of economies beyond commodities can reduce reliance on volatile export markets and enhance foreign exchange earnings, including US dollars. Likewise, promoting value addition in exports and expanding export markets can increase foreign exchange earnings in US dollars and reduce import dependence.

2. Strengthening Local Currency Liquidity and Financial Institutions: Enhancing local currency liquidity through effective monetary policies, exchange rate stability, and deepening the local financial markets can reduce dependence on the US dollar for domestic transactions. On a related note, strengthening local financial institutions in Africa is essential for sustainable trade finance. By enhancing their capabilities and expanding their reach, these institutions can better support trade activities, provide liquidity, and facilitate financing options denominated in local currencies.

3. Promoting Regional Integration and Local/Regional Currencies: Promoting regional economic integration and intra-regional trade can facilitate trade settlements in local currencies, reducing reliance on the US dollar for regional transactions. Here, African countries may explore using local currencies or regional currencies, such as the African Continental Free Trade Area (AfCFTA) digital currency, to facilitate intra-African trade. This would reduce reliance on the US dollar and mitigate the impact of US dollar liquidity challenges.

4. Enhancing Financial Sector Resilience: Strengthening domestic financial institutions, improving risk management frameworks, and encouraging innovation in financial services can enhance the resilience of the financial sector and promote trade finance. African countries can work towards strengthening regional financial infrastructure, including payment systems, clearing mechanisms, and settlement platforms. Enhanced regional integration would foster efficient trade finance processes within Africa, reducing the need for US dollar-based transactions and minimising associated liquidity challenges.

5. Collaborative Partnerships: Collaborating with international partners, including multilateral development banks and foreign investors is critical, as they can provide support through technical assistance, investment, and capacity building to address US dollar liquidity challenges in SSA. Further, Development Finance Institutions (DFIs) such as the African Development Bank and regional development banks, can play a crucial role in providing trade finance facilities to bridge the liquidity gap. These institutions can offer financial products tailored to African businesses, mitigating risks associated with US dollar liquidity challenges and supporting trade activities.

6. Settlement in Alternative Currencies: India and China are the biggest trading partners with most of the sub-Saharan African countries and recently, the Indian Central Bank (RBI) has allowed 18 countries, including 6 countries in SSA (Kenya, Tanzania, Seychelles, Mauritius, Botswana, and Uganda) to settle their international trade transactions in rupees. This initiative will help in reducing demand pressure on the US dollar by providing an alternative currency for settlement of international trade transactions.

7. Harnessing technological innovations: On an overarching note, technology-driven innovations, such as blockchain and digital currencies can offer alternative solutions for trade finance in Africa. Blockchain-based platforms can facilitate secure and transparent trade finance transactions, while digital currencies can streamline cross-border payments and reduce dependence on US dollar liquidity.

By adopting these measures and pursuing a comprehensive strategy, sub-Saharan African countries can work towards overcoming US dollar liquidity challenges, promoting trade finance, and fostering sustainable economic growth in the region.

Thus, despite the challenges posed by US dollar liquidity constraints, there are promising avenues auguring well for the future of trade finance in Africa.

Indeed, through currency diversification, regional integration, and collaborative efforts, suitably synergised by technological innovations, African countries can navigate the challenges and seize opportunities to promote trade, economic growth, and financial stability within the continent.