Housing landscape in Dar es Salaam: Luxury apartments at Mbezi Beach, recently constructed complete with a swimming pool and gym.

By TZ Business News Staff.

A rapid shift of focus from traditional banking services (which were short-term business loans and the safe keeping of customer deposits) in Tanzania, has been noticed as a myriad of banks in the country take advantage of an obvious housing bubble.

The shift, apparently following a call three years ago from the National Housing Corporstion (NHC)asking banks in Tanzania to consider paying attention to mortgage lending because the nation was experiencing a dire housing need, has been noticed by the Bank of Tanzania (BoT).

“The mortgage market [has] continued to grow steadily, recording an annual growth rate of 46%. Nineteen lenders are now offering mortgage products with more due to enter the market,” the Bank of Tanzania has said in its latest report on bankers attitude on the mortgage market in Tanzania.

A housing bubble is a market situation in which high demand propels both rapid growth in construction activity and speculation in landed property, which—if mismanaged–may be followed by oversupply and the consequent bust of the bubble as property values tumble.

“As at 31st December 2013 total lending by banking sector for the purposes of residential housing was TZS 156.50 billion, which is equivalent to USD 96.8 million. This represents an annual growth of 46%. [The] total number of mortgage loans also grew rapidly, from 1,889 at the beginning of 2013 to 2,784 by end of December 2013, being an increase of 47%,” the Central Bank has reported.

“Factors attributed to this increase include a favorable interest rate environment during the year, increased awareness on mortgage loans among borrowers, public awareness campaigns by major banks as well as the launch of mortgage loan product by CRDB Bank Plc, Exim Bank and other TMRC member banks that had no such a product.”

Mortgage lending is a new phenomenon in Tanzania since the collapse of the state-owned Tanzania Housing Bank (THB) in the late 1980s, so that Tanzanians had been left to struggle building family houses on their own using what meagre personal finance they could raise.

Research conducted by Tanzania National Housing Corporation (NHC) found Tanzanians spent 10 years to complete a family house using personal finance, according the NHC Director General Nehemia Mchechu as quoted in the media. But financial constraints have made it difficult for people to build homes, creating a big housing supply and demand gap.

According to Mchechu, Tanzania has a demand for 200,000 housing units annually, but only 15,000 units are constructed. This has created a big deficit that has resulted in housing prices spiral. The country currently has a housing deficit of three million units, according to NHC published findings, but the housing shortage has been increasing as Tanzania’s population grows.

Studies have also established that between 1964 and 1969, Tanzania had a housing shortage of around 21,000 housing units in urban areas alone. The number rose to 25,000 at the end of the second five-year development plan (1969-1974) – and to 300,000 in 1982. It is now estimated that the shortage in urban areas is above 1.2 million houses. To help resolve this problem, the NHC Director General asked banks to form a Housing finance Scheme.

Mchechu was quoted as saying “even if there were ten NHCs, this would never end the housing shortage problem in Tanzania.” He asked banks to get into the mortgage market. With this understanding in mind , Mchechu went beyond banks; he went as far as looking for foreign investors to partner with in the housing construction crusade.

Tanzanian banks, the NHC and other financial institutions have seen an opportunity and the bubble is bulging.

“The construction of new houses by the National Housing Corporation (NHC) over the next 3

years will have a positive effect on the mortgage market as most of these will most likely be

priced at affordable levels.

“Likewise new schemes such as the Civil Servants Housing Scheme which is expected to build 50,000 affordable houses in the next 5 years have the potential to boost the mortgage market even further. Most Pensions funds are also actively engaged in advancing mortgage loans to their members, something which will further boost the mortgage market in Tanzania,” the Bank of Tanzania says in its latest report.

“The Government of Tanzania has also continued to demonstrate its commitment to ensuring

the Tanzanian populace has access to affordable housing. The recent launching of a project for

construction of 10,000 houses under the Tanzania Building Agency by the Vice President is a

clear demonstration of such commitment, and it will boost further growth of mortgage market,” BoT says.

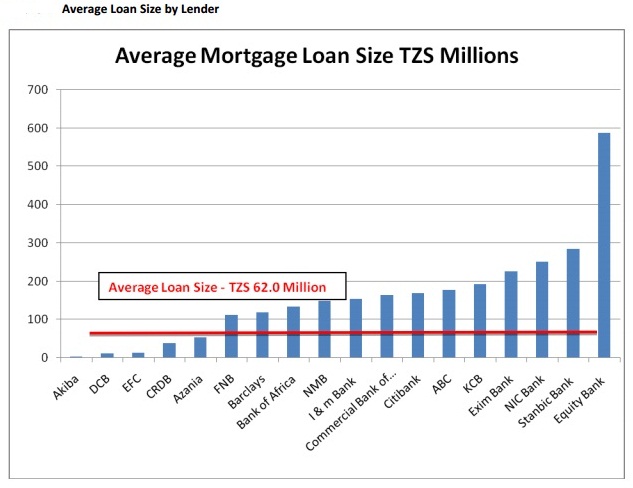

On mortgage attitude in the banks, BoT reports that the “average loan size as at 31st

December 2013 was TZS 62million, which is equivalent to USD 38, 000, [and that] the average loan size for 2013 compares unfavorably with that of 2012 which was TZS 73 million.

“The average loan size across mortgage lenders varied greatly, reflecting different strategies and customer bases. Akiba, EFC and DCB who target lower income customers had much lower average mortgage loan sizes than Stanbic Bank whose average loan size was TZS300 million.”

Although mortgage interest rates are still considered too high between 15% and 21%, more banks are expected to enter the mortgage market.

As at the end of December 2013, 19 different banking institutions were offering mortgage

loans, with the number expected to increase even further as more lenders continue to launch

mortgage loan products, BoT says, adding that the mortgage market was dominated by three top lenders, who amongst themselves command about 67% of the mortgage market. Azania Bank, which has the longest presence in the mortgage market, was a market leader commanding 24% of market share, closely followed by Stanbic Bank with about 21% of the mortgage market share.

The market experienced new entrants and there are prospects that large banking institutions such as NBC and NMB will enter the mortgage market as competition in the traditional banking products continue to intensify.

CRDB announced its entry into long-term mortgage lending last year. CRDB Bank Managing Director Dr. Charles Kimei said late last year his bank was now offering long-term mortgage loans, bringing new hope to millions of Tanzanians whose dreams of house ownership were dampened by high costs of construction materials.

But the CRDB Bank mortgage loans would attract an interest rate of 18 per cent or better, the banker was quoted as saying. One would also require a 1.0 per cent insurance cover for the loan.