Averting the risks should involve maintenance of financial austerity, improving monetary policy and improving the business environment.

By TZ Business News Staff.

It should not come as a surprise to anyone if reports should come out a few months after this July, 2016, that say Tanzania is experiencing rising unemployment, rising inflation and a deteriorating Gross Domestic Product growth.

The International Monetary Fund (IMF), which has had a working relationship with Tanzania for years released a press statement on Wednesday, July 20, 2016, sounding a macroeconomic warning for East Africa’s second largest economy.

“Tanzania’s macroeconomic performance has been strong under the [IMF] Policy Support Instrument. Growth has remained close to 7 per cent and inflation is moderate.

“Most quantitative program targets for end-2015 were met, while progress on structural reforms slowed due to the transition to the new government,” the statement said then added: “The macroeconomic outlook is favourable, supported by the authorities’ ambitious development agenda, although risks are tilted to the downside.

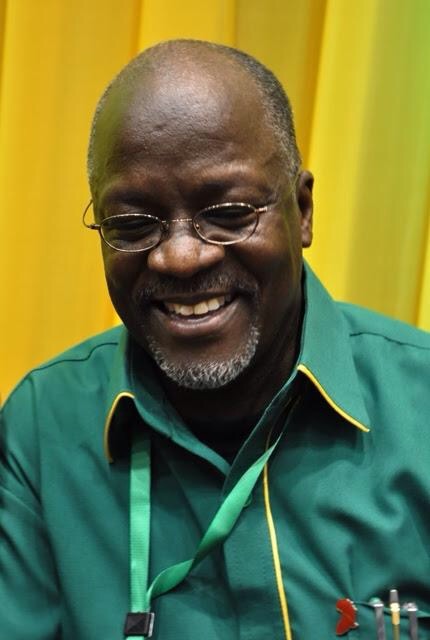

The way out of the perceived risks should include resolve to not spend money beyond what will be available to the government [currently under President John Pombe Magufuli]–by “creating fiscal space for higher infrastructure investment through sustained efforts to raise domestic revenue and increasing spending efficiency, particularly in public investment,“ the Fund said.

Other measure should include improving the business environment, and a foreseen need to improve the monetary policy environment.

The IMF Executive Board, which on July 18, 2016 completed the fourth review of Tanzania’s economic performance under the program supported by the Policy Support Instrument (PSI) also concluded the 2016 Article IV consultation with Tanzania. The press statement was issued following the Board discussion chaired by Mr. Min Zhu, Deputy Managing Director and Acting Chairperson of the Fund.

IMF Executive Directors commended Tanzania’s strong macroeconomic performance, with high growth and low inflation, and noted that, notwithstanding some delays in the structural reform agenda, the outlook remains favourable, although downside risks and challenges persist.

While macroeconomic management has been able to deliver fiscal sustainability and macroeconomic stability, the quality of fiscal management deteriorated until recently in some areas (e.g., expenditure arrears control) and the pace of reform has abated in recent years.

The modernization of monetary policy has made only limited progress in the past two years. The business environment remains challenging and the perception of corruption has increased substantially.

“Despite significant progress in recent years, financial development remains low,“ the IMF said. “Further development would support higher growth, as well as improve the overall effectiveness of macroeconomic policy. Beyond credit growth, financial development will require further improving access, particularly for businesses, and reducing high borrowing costs. Further development of the interbank and government debt markets is also desirable. “

“Vigorous reforms will be required to foster further structural transformation of the economy. The authorities’ focus on creating a better environment for business and job creation is welcome, like the authorities’ strong drive against corruption.

“Improving the financial sustainability of the public electricity utility, TANESCO, is critical for the development of the energy sector. Tanzania could also benefit from the completion of the East African Community common market,” the IMF said.

In the statement issued after the meeting, the IMF said the strong growth and macroeconomic stability which Tanzania has achieved over the past two decades were a result of market-oriented reforms and prudent macroeconomic policies, adding that the growth had been driven by construction, services, and basic manufacturing, while the economy had also become more diversified.

Inflation, while still volatile, has remained moderate. Poverty has decreased but remains high (at 28.2 per cent of the population, based on the national poverty line) with a large population of underemployed youth, the Fund said in the statement. They however added that despite substantial progress toward the Millennium Development Goals (MDGs), Tanzania is likely to have missed about half the 2015 targets.

The IMF Board of Directors noted that improving the business environment will be critical to spur long term competitiveness and job creation, and also encouraged continued efforts to improve governance and combat corruption.

Sustaining high growth and implementing the development agenda while preserving fiscal and external sustainability will require a range of reforms. Somewhat higher fiscal deficits could be sustained for a few years while keeping a low risk of debt distress.

However, creating fiscal space for higher infrastructure investment through sustained efforts to raise domestic revenue and increasing spending efficiency, particularly in public investment, is imperative.

“The implementation of the 2016/17 budget will be a first test of the authorities’ capacity to reconcile these various objectives. Careful prioritization and implementation of expenditures will be required to ensure that spending does not exceed available resources and to avoid domestic arrears accumulation.

Growth has remained strong and inflation moderate in the past two years. Real GDP grew by 7 percent in 2015, with activity particularly buoyant in the construction, communication, finance, and transportation sectors. Inflation remained in single digits throughout 2015, averaging 5.6 percent, despite the significant exchange rate depreciation in the first half of 2015.

Inflation in April 2016 was 5.1 percent, close to the authorities’ target of 5 percent. The external position recorded mixed developments. The current account deficit declined from 10.7 percent of GDP in 2013/14 to a projected 8.6 percent in 2015/16, mainly due to lower oil prices.

The surpluses in the capital and financial accounts, however, narrowed due to lower donor support and foreign direct investment related to natural gas exploration.

International reserve coverage is estimated to have declined somewhat to 3.6 months of prospective imports of goods and services in June 2016. The banking system appears sound overall, but there is wide variation within the system.