By TZ Business News Staff and Agencies.

In theory, a nation swimming in wealth from ‘depletable’ natural resources such as oil, can create ‘economic insurance’ to remain rich even after the natural resources run out by storing some of that wealth in a sovereign fund. In 2012, The Angolan Government created the sovereign fund Fundo Soberano de Angola, or FSDEA, for this purpose.

But it turns out this fund is benefitting a private person instead of citizens of this Southern African Development Community (SADC) nation. Since its launch in 2012, Fundo Soberano de Angola has come under scrutiny because of its structure and concerns about how it is managed.

Findings made public by the International Consortium of Investigative Journalists (ICIJ) through a series of reports called “Paradise Papers” reveal that Mr. José Filomeno dos Santos, son of Angola’s former President José Eduardo dos Santos entrusted USD 5 billion from the sovereign fund to be managed by an individual who apparently collects questionable personal benefits from the public funds.

FSDEA Chairman, José Filomeno dos Santos, was appointed by his father, then president of Angola, José Eduardo dos Santos, who led the country from 1979 until this year (2017).

The younger Dos Santos’ appointed one Jean-Claude Bastos de Morais, a personal friend, to manage the fund. Investigative reporters have discovered the Sovereign fund dollars were whisked out of Angola to be invested in Mauritius, where the money is now being used for questionable private gain.

A sovereign wealth fund consists of pools of money derived from a country’s reserves and is supposed to be set aside for investment purposes to benefit the country’s economy and citizens when the source of riches weakens at some future point.

The funding for a sovereign wealth fund comes from central bank reserves that accumulate as a result of budget and trade surpluses, and from revenue generated from the exports of natural resources.

The Economy of Angola is one of the fastest-growing in the world, with reported annual average GDP growth of 11.1 percent from 2001 to 2010. This growth is mainly driven by riches from extensive oil and gas resources and diamonds.

High international oil prices and rising oil production contributed to the strong economic growth since 1998, but corruption and public-sector mismanagement remain significant, particularly in the oil sector, which accounts for over 50 percent of GDP, over 90 percent of export revenue, and over 80 percent of government revenue.

Bastos, the Angolan fund and the Mechanics of Looting

The Angolan sovereign wealth fund, Fundo Soberano de Angola, or FSDEA, manages $5 billion on behalf of a country where, despite its considerable oil wealth, one in three people lives in poverty and where corruption among government elites is perceived to be widespread.

FSDEA has come under scrutiny because of its structure and concerns about how it is managed.

The younger Dos Santos’ appointment of Bastos, a personal friend, to manage the fund – which included billions of dollars set aside for investment in Africa and that would use companies in Mauritius – drew the attention of journalists.

In a statement to ICIJ, the FSDEA said, “Quantum Global was selected because of its exemplary performance on previous mandates with the Angolan authorities, its availability to carry out capacity building programs and commitment to develop a regional private equity management partnership with FSDEA.”

In a separate statement, Quantum Global denied that the relationship between Bastos and the Angolan president’s son influenced the FSDEA’s selection. Quantum Global told ICIJ that its selection was due to its “expertise investing in the continent” and its having outperformed other fund managers.

Bastos Activities

Jean-Claude Bastos de Morais was trying to invest offshore but was having a hard time finding a place to put his money.

The 50-year-old Swiss-Angolan financier turned to Appleby, an elite law firm with offices in tax havens around the globe.

First, Bastos tried Appleby’s office on the island of Jersey, a popular offshore financial center in the English Channel. But Appleby employees there balked at his 2011 request to set up a shell company without being told why it was needed or what assets it would hold. One thing that concerned Appleby’s Jersey lawyers was the possibility that the shell company would own a shipping port in corruption-prone Angola.

Next Bastos, an amateur tennis player who runs an asset-management firm, Quantum Global Group, tried Appleby’s office on the Isle of Man, in the Irish Sea. Appleby’s management there decided that Appleby would require a seat on the offshore company’s board of directors to exercise some supervision over what they described as his high-risk business. The arrangement did not go ahead. Bastos then tried his luck at Appleby’s Mauritius office.

Appleby vets Bastos

The Appleby records show that the law firm did its own research on its new client. A compilation of internet search results compiled in January 2014 by an employee at Appleby’s Mauritius office included media references to lingering “questions” about how the fund would operate.

The Appleby employee highlighted in yellow an article included in the search results that noted the “close personal” friendship between Bastos and dos Santos.

Appleby’s customer-screening process also flagged media accounts of Bastos’ past legal problems in Switzerland.

Records show that Appleby’s Mauritius office had classified Bastos as a “risky client ” but moved forward with its new business.

The first step was getting a coveted Mauritius business license. In a letter accompanying Quantum Global’s license application, Appleby’s Mauritius office told regulators that it had “made all reasonable enquiries” into Bastos, Quantum Global and their plans to manage the Angolan money.

On the application form – supplementing a question about whether any company director had been convicted, penalized or sanctioned in court – a summary was appended in which his personal lawyer disclosed that Bastos had paid a $5,390 fine after a Swiss court convicted him in 2011 of approving loans that he shouldn’t have.

Bastos’ lawyer, however, failed to mention that the Swiss court had also imposed a suspended fine of nearly $188,646. The application form also didn’t mention that the Swiss court also found Bastos guilty of withdrawing about $100,000 from a company account without authorization, according to a copy of the judgment obtained by ICIJ media partner SonntagsZeitung.

Bastos acknowledged the suspended fine but told ICIJ that the larger of the two fines did not have to be paid under a good conduct probation provision. Bastos said the suspended fine and convictions have since been expunged from Switzerland’s register of convictions. “The authorities were informed correctly,” Bastos said.

‘Please do not share’

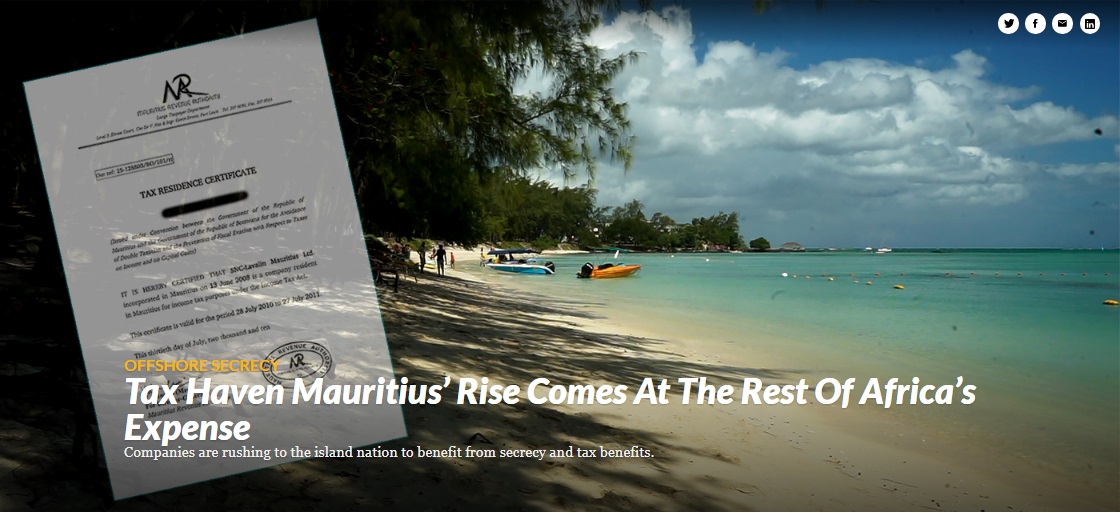

With the license approved, Appleby’s Mauritius office helped Bastos and his company move some Angolan public funds slated for the management of investments in African hotels and infrastructure. The money moved through offshore companies in three jurisdictions – including some incorporated in Mauritius, known for its low taxes and high tolerance for secrecy.

In an email sent to Appleby’s Mauritius employees to remind them of the sensitivity of their new client, Quantum Global’s lawyer wrote – in boldface type – that a British Virgin Islands company called Red Sahara Ltd. (later renamed QG Investments Ltd.), which would later receive tens of millions of dollars in dividends, was ultimately owned by Bastos. The information was “highly confidential,” the lawyer wrote. “That is to say, please do not share any information.”

The Angola fund once paid $20 million for shares in a company incorporated in the British Virgin Islands, Capoinvest, which was helping to finance the development of a major port in northern Angola. In its 2014 annual report, Angola’s sovereign wealth fund twice mentions Capoinvest, which also owns the Angolan company that is developing the port. There is no mention, however, of the additional offshore companies that own Capoinvest. Appleby’s files reveal it is owned by a chain of three companies incorporated in the British Virgin Islands and two more in the Seychelles, in the Indian Ocean, all of them ultimately owned by Bastos.

In his statement, Bastos said Quantum Global complies “in all countries with legal, tax and regulatory standards.” He said, “I have routinely disclosed my shareholding in Capoinvest.”

Mauritius also provided a low-tax haven for substantial fees the Angolan fund paid Bastos’ operation. The financial statements of QG Investments Africa Management Ltd., Bastos’ Mauritius company, show it received $63.2 million in management fees throughout 2015, of which $21.9 million was sent to a Quantum Global company in Switzerland.

“The fees seem extraordinarily high,” said Andrew Bauer, an economic analyst and sovereign wealth fund expert who reviewed the fee payments.

Records show one Bastos-owned company paying dividends to another. In 2014 and 2015, QG Investments Africa Management paid $41 million in dividends to his QG Investments, based in the British Virgin Islands.

Bastos told ICIJ that Quantum Global was paid advisory fees “according to standard industry practices, all of which have been and continue to be fully disclosed.”

He said that “as any other shareholder, I am earning dividends out of the distributions of my companies.” He said his ownership of QG Investments Africa Management is tax-efficient.

Bastos declined to comment on “confidential business matters” that led him to approach Appleby offices in Jersey and the Isle of Man.

Bastos said Quantum Global chose Mauritius because of its its low taxes, “excellent infrastructure, relaxed reforms” and advantageous tax treaties, known as “double taxation agreements,” with most African countries. See the detailed report here: Paradise Papers on Angola.