…Tanzania Supports Cotton Farmers Amid Volatile Global Prices.

BY NICHOLAS BARIYO of Wall Street Journal.

Three years ago, Tanzanian cotton farmer Alex Mushambo nearly left his six-acre plot to become a day laborer in the city. Now he’s set for a bumper harvest, and contributing to a broader revival of a major African cotton producer.

“The rains have now stopped but the plants are looking good,” said the 38-year-old father of four. “This is a very promising season.”

Tanzania, Africa’s fourth biggest cotton producer, has turned around its cotton production after a policy shift that has been welcomed by farmers and grudgingly accepted by buyers. In 2011, the government introduced contract- farming that encourages farmers to sign purchase contracts with ginners, who turn the raw product into fiber for textiles and seed for cooking oil. The farmers receive credit from ginners to buy pesticides, fertilizers and other farm needs. In return, the farmers agree to supply certain quantities and qualities of cotton to their buyers.

Tanzania’s cotton production has climbed sharply since the program was introduced, though it is projected to fall this season as some ginners are unhappy with the artificially high contract prices that they have been forced to pay cotton growers, especially now that global prices of cotton are falling. Output levels are projected to reach around 280,000 metric tons this season ending January 2015, but this is still more than double compared with before the introduction of price-support initiatives under contract- farming.

Under the contract-farming system, aging farms have been revived; new areas have opened to cultivation; and farmers who abandoned cotton crops for work in the cities are returning to their plots. Tanzania’s cotton plantings have increased to an average of 1.2 million hectares in the past three seasons, from around half a million hectares five years ago. Fans of the government program say new markets can absorb the extra production to support local prices. By contrast, some traditional cotton powerhouses have suffered production declines—including Uganda and Zambia, where the governments blame volatile global prices for deterring farmers from investing in the crop.

“Contract farming is giving Tanzanian farmers a chance to boost yields and (provides) access to markets, which have been key missing links in the industry for a long time” said William Creighton, the project manager with Gatsby Trust, one of the organizations helping the government to implement contract farming.

Maro Kuludisha, a farmer in Tarime district who had abandoned cotton cultivation in 2003, resumed planting last year. His return followed seasons of back—to- back favorable prices—and seeing his neighbors doing much better financially.

“I don’t want to be left behind,” he says.

However, Tanzania’s ginners aren’t completely happy with Tanzania’s shift to contract-farming. They accuse the Tanzanian government of failing to consult them when setting indicative prices for buying cotton. They warn artificially high prices will jeopardize the program.

“It is very important to have a say in the pricing, if we are to fulfill our commitment to farmers,” said Boaz Obiero a project officer with Alliance Ginneries.

Tanzania has a long and troubled relationship with King Cotton. The country has long supplied cotton lint—used to make high-quality yarn-dyed cotton shirts—to Asia and Europe. But when textile giants the U.S., China and India began supplying the market, at the turn of the 21st century, Tanzania’s ginneries closed and output plummeted to about a fifth of what it is now.

Now the government wants to use contract-farming program to become a continental cotton power again.

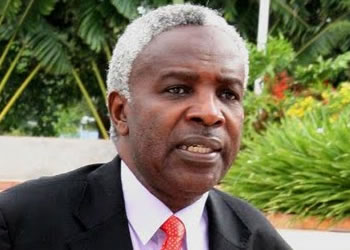

Christopher Chiza, Tanzania’s agriculture minister, defends the contract-farming program from critics who say high prices make it unsustainable.

He says a new program, to be rolled out in July, will allow market forces to determine prices. The government will refrain from setting indicative prices, but will intervene through the Cotton Price Stabilization Fund to support farmers who are having trouble repaying loans when prices fall below a certain level, he said. The finance ministry allocated some 120 billion Tanzanian shillings ($72 million) to the Fund. This money is available to support the cotton price should it fall to less than 750 Tanzanian shillings a kilogram—this season. Last season, government had set a price of 700 Tanzanian shillings per kilo. “We are doing everything we can to motivate farmers,” says Mr. Chiza.

The Tanzanian government is eager to support more than half a million farmers in the cotton sector, to boost output, exports and fight rural poverty. The government has been facing an ultimatum from the opposition, since 2012, to address poverty and fix the economy or face mass protests.

Unfortunately, the global market may not cooperate. After hitting a historic record of $2.1515 a pound in March 2011, cotton prices have dropped sharply, battered mainly by a global economic crisis as well as slowing growth from China, the world’s largest importer. And with the move to market prices, the government’s cotton aspirations seem ambitious. Source: Wall Street Journal.