…as Central Bank Discount Rate is dropped from 16% to 12%

…the cut has come in a bit late but it’s a very welcome move.

By TZ Business News Staff.

Stakeholders in the Tanzania business sector have welcomed the recent Central Bank discount rate drop from 16% to 12%, describing it as a significant step toward reduction of the cost of business capital.

Bank loans should now become cheaper with this rate reduction, Magweiga Munanka Samo, a businessman operating in the construction and transport sectors in Dar es Salaam and Tarime, Mara regions told this website.

“This step will increase money supply in the economy, which should lead into increased productivity of the business sector,” Samo said; but the businessman complained, “the move has come in a bit late but it’s going to be very good for business.” (see our earlier analysis here).

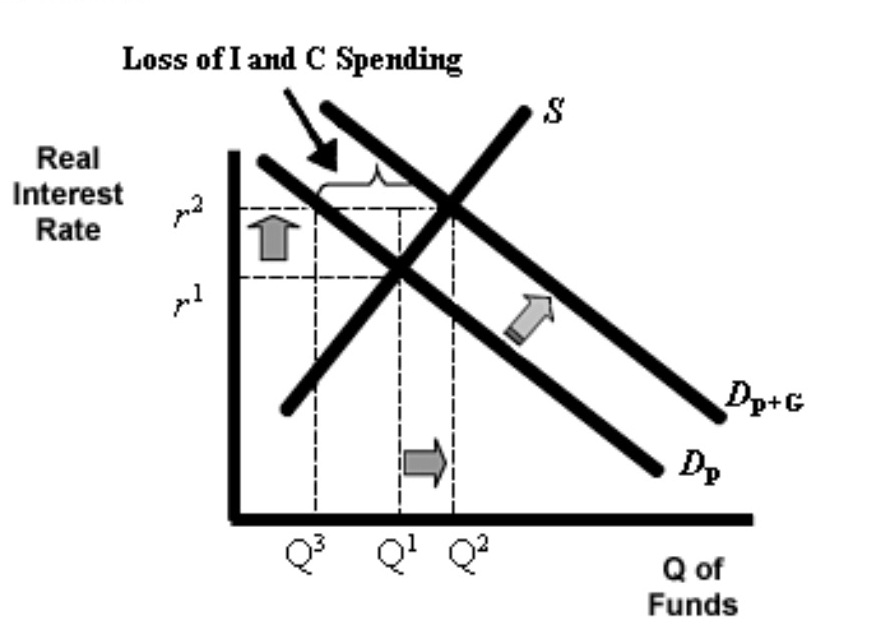

Commercial banks borrow money from the central bank. The discount rate is the interest rate commercial banks pay the central bank for money they borrow from the central bank. When the central bank reduces the discount rate, commercial banks also reduce their lending rate to entrepreneurs, which then makes bank borrowing attractive to businesses.

On Monday, March 6, 2017 the Bank of Tanzania (BoT) issued a circular to commercial banks informing them it had reduced the discount rate from 16% down to 12% to help spur lending and boost economic growth. The circular marked the first time the lender of last resort had lowered borrowing costs since 2013.

On Monday, March 6, 2017 the Bank of Tanzania (BoT) issued a circular to commercial banks informing them it had reduced the discount rate from 16% down to 12% to help spur lending and boost economic growth. The circular marked the first time the lender of last resort had lowered borrowing costs since 2013.

On Thursday, March 9, 2017, the Bank of Tanzania Governor, Prof. Benno Ndulu, met Chief Executive Officers (CEOs) of commercial banks and other financial institutions in Dar es Salaam and urged them to take note of the downward review of the discount rate meant to spur credit growth in the economy. The meeting was part of the financial institutions traditional bi-monthly get together where they discuss economic trends.

“The Bank of Tanzania’s expectations are that [the discount rate drop] will enhance credit growth and reduction in lending rates,” the Governor said.

Prof. Ndulu cautioned the stakeholders however, to ensure that only bank loan customers with good track records are considered, explaining that this was due to the recent increase in non-performing loans (NPLs) among many banks.

When BoT reviewed the discount rate from 16 to 12 per cent on March 6, 2017, it said the revised discount rate took into account the prevailing 91 and 182-day weighted average yields and the monetary policy stance geared towards sustaining price stability, adding that the drop will also be used to discount Treasury securities.

A BoT statement said CEOs attending the Thursday meeting sought an assurance on the duration of the newly announced discount rate, lest they adjust their loan policies only for the discount rate to move upward without a warning.

The Governor assured them the rate will hold for a while and that any adjustments would depend on prevailing economic conditions, but assured them such changes will not be drastic.

The central bank statement made available to this website concedes a very sluggish money supply growth rate in 2016.

“Monetary aggregates sustained slow growth of 2.9 per cent in the year ending December 2016 as against 18.8 per cent growth recorded in the corresponding period in 2015,” the statement reads in part. “ The slow growth is attributed to decline in net foreign assets of the banking system and net credit to the government.

“Also credit to the private sector grew by only 7.2 per cent in the year ending December 2016, compared with 24.8% in the year ending December 2015. This was associated with banks’ elevated cautiousness in lending in the face of increase in non-performing loans (NPLs) and low foreign budgetary inflows.”

The CEOs were told that global and domestic conditions remain favorable for continued price stability and that the Bank of Tanzania will continue to manage short-term liquidity fluctuations using various monetary instruments, with reduction of the discount rate also contributing to ease liquidity conditions among banks.

Although business sector stakeholders concede the move is set to benefit the economy, they caution there are areas that need careful attention.

Samo said increasing money supply alone may not help the economy if other measures are not taken into consideration, such as the need for proper management of foreign exchange and encouragement of export trade by removing nuisance export taxes. There is a myriad of export trade charges which make exporting cumbersome, he said. These should be removed. He also called for a keen eye on the bureau de change network which appears a bit overcrowded for no good reason.

A loan officer working in the National Bank of Commerce (NBC) who asked not to be identified said the fight against corruption should continue as effort to grow the economy continues because corruption carries with it potential to damage economic growth efforts.

A different source described how several small businesses were destroyed by the National Microfinance Bank (NMB) at Rungwe and Songea branches in 2013 as a result of corruption in the bank loan department.

Bank staff gave loans to enterprises in the two branches then turned around asking for part of the loaned money–which consequently destroyed the planned expenditure and damaged the small enterprises as a result. Bank staff in the Songea and Rungwe NMB branches were transferred or sacked, but the damage to the small businesses had already been done.

Reuters News agency has quoted chief executive of the Dar es Salaam-based Institute of Management and Entrepreneurship Development, Dr. Donath Olomi, as agreeing that the discount rate reduction will stimulate economic growth by encouraging banks to lend rather than investing in Treasuries and government bonds, but he cautioned investor confidence is low in the country and something should be done about it.

“The government also needs to issue a signal to boost investor confidence, which has fallen because of various actions by public officials that are seen to have undermined the sanctity of private ownership,” the business management academic and entrepreneur told Reuters.

Uncertainty among some investors seems linked to President John Pombe Magufuli’s crack down on tax avoidance and his declared interest to review some contracts. In a related incident, the Tanzania ministry of energy and minerals recently banned the exports of copper concentrate and other metallic mineral ores with immediate effect, causing a plunge in the share price of the London-listed gold miner–Acacia Mining Plc, according to a Reuters report.