By TZ Business News Staff and Agencies.

The African Energy Chamber has called on energy resource rich African nations to maintain efforts that encourage Foreign Direct Investment in oil, gas and renewables, to avoid missing out on energy-based revenue in the long run.

In a statement released in Johannesburg on Tuesday, April 13, 2021 the Chamber identifies energy-rich Eastern Africa nations as Mozambique, Kenya, Uganda and Tanzania where a liquefied natural gas project is losing value ‘frozen in bureaucratic ice’.

The African Energy Chamber has prodded energy-rich African nations to ‘go the extra mile’ encouraging FDI in the energy sector because this will bring benefits in the post-COVID 19 economic recovery on the continent.

“It is not an option to slow or postpone time-sensitive developments that promise to harness natural resource wealth and make sustainable improvements in standards of living across the continent. Africa requires a sustained flow of investment and has proven time and again that it offers the scope of projects and magnitude of resources that are worthy of foreign capital,” the statement reads.

“African Energy Developments Demand Sustained Investment with new projects in Mozambique, Tanzania, Uganda, and Senegal,” the Chamber states.

Uganda seems to have gone the extra mile: on Sunday, April 11, 2021 Uganda and the French Company Total signed an agreement to initiate construction of a 1,443 kilometer crude oil pipeline from Hoima District in Uganda to the Indian Ocean port of Tanga in Tanzania.

The pipeline will start at Buseruka, Hoima District in Uganda’s Western Region– where 6.5 billion barrels of crude oil were discovered. It will then travel south-easterly to pass through Rakai District in Uganda, then pass through Bukoba in Tanzania, loop around the southern shores of Lake Victoria, continue through Shinyanga and Singida regions to end at the Tanga port.

Tanzania President Samia Suluhu Hassan represented her country at the signing ceremony held at Uganda’s Entebe State House. President Yoweri Museveni led the Uganda delegation while Total chairman and chief executive Patrick Pouyanne led the French company’s team, according to reports.

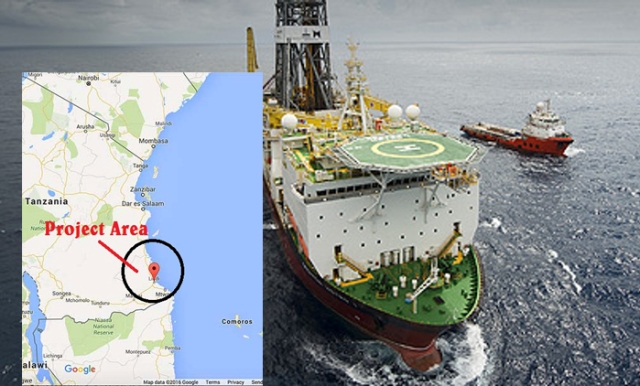

In the meantime, the Norwegian state-owned energy company Equinor has downgraded the book value of its Tanzania LNG project (TLNG) on the company’s balance sheet by USD 982 million. The Tanzania LNG project in Lindi region, planned to monetize 57 trillion cubic feet of natural gas in the Indian ocean has been a non starter, fickling about investing since 2014.

The multimillion-dollar LNG project has been in limbo waiting for a ‘Host Government Agreement’—the pact that governs the rights and obligations of parties with respect to the development, construction, and operation of the project.

The government is working with Norwegian oil and gas firm Equinor, and Royal Dutch Shell to ensure that the LNG project is implemented.

To explain why it has written down the book value of this asset in Tanzania, Equinor has said while progress has been made in recent years on the commercial framework for TLNG, overall project economics have not yet improved sufficiently to justify keeping it on the balance sheet.

“The TLNG project has an anticipated breakeven price well above the portfolio average for Equinor and is, at this time, not competitive within this portfolio,” the company adds.

Tanzania Invest has nevertheless quoted the company as saying “Equinor will continue to engage with the Government of Tanzania in negotiations on a commercial, fiscal and legal framework that may provide a viable business case for TLNG in the future.”

Tanzania LNG Project, also known as Tanzania Liquefied Natural Gas Project (TLNGP), also as the Likong’o-Mchinga Liquefied Natural Gas Project (LMLNGP), is a planned liquefied natural gas processing plant to be located on the Indian Ocean coast on Tanzania, opposite the country’s main offshore gas exploration sites.

Tanzania has proven natural gas reserves of 57 trillion cubic feet, with at least 49.5 trillion cubic feet of those reserves far offshore in the Indian Ocean. The Ministry of Energy of Tanzania first announced its intention to develop an LNG plant in 2014.

The Energy Chamber says FDI is vital to Africa’s growth, and while it may be challenging to procure capital in a tepid global economy, it is even more difficult not to.

Yes, COVID-19 has put emerging producers in a tough spot: new exploration is seen as risky, and new producers lack existing assets or low-cost development of marginal fields on which to fall back, the Chamber says, adding:

“Without sustained levels of FDI continuing to move the needle on oil, gas and renewable developments, energy export revenues run the risk of being stranded and resources left undeveloped. For emerging producers like Uganda – as well as Tanzania, Kenya, Mozambique, among several others – this would mean foregoing critical government revenues that could aid in a much-needed, post-COVID-19 economic recovery.”

A recent uptick in direct investment activities in Africa’s energy sector sheds light on the role of sustained investor interest in catalyzing socio-economic growth, the Chamber says.

In the past twelve months, the African energy sector has seen several encouraging developments – in the form of both Foreign Direct Investment (FDI) and strategic partnerships – that have advanced the sustainable development of its natural resources.

In fact, despite a global downturn in investment in 2020, FDI flows to developing economies accounted for 72% of global FDI, the highest share to date. Given the magnitude of Africa’s oil and gas reserves – not to mention its abundant renewable resource wealth – the continent remains a highly attractive market for inbound investment, which is vital for its growth.

Take Uganda, for instance, which is home to one of the largest onshore discoveries in sub-Saharan Africa.

Following multiple petroleum discoveries in Uganda’s Albertine Graben – estimated to contain 6.5 billion barrels of oil, of which 1.4 billion are considered recoverable – foreign investments into the country are expected to reach nearly $20 billion.

Last April, Total E&P Uganda B.V. signed a Sale and Purchase Agreement with Tullow Oil PC, through which Total will acquire Tullow’s entire 33.34% interests in Uganda’s Lake Albert development project and the East African Crude Oil Pipeline (EACOP).

Five months later, the Ugandan Government and Total signed a host government agreement for EACOP, representing a significant step toward reaching a final investment decision. The deal pushes along an extended development process – slowed by infrastructure issues, tax complications, then COVID-19 – that not only promises to bring first oil by 2022, but also provides a pathway to monetization via associated transport infrastructure.

In addition to developments at Lake Albert, the Ugandan Government has proven its commitment to attracting FDI to its hydrocarbon sector through its second licensing round held last year, as well as its invitation to local and foreign entities to forge joint-venture partnerships with the Government.

By prioritizing the establishment of mutually beneficial partnerships, the emerging East African producer aims to facilitate the successful transfer of skills, knowledge and technology, initiating an influx of technical expertise and working capital into the country.

“Those who have been locked out from access to opportunity want the same from the energy sector that the energy sectors want from governments. We must not forget local content, local jobs, local opportunities especially for young people and women” Stated NJ Ayuk Executive Chairman of the African Energy Chamber.

Meanwhile, in West Africa, Senegal has been reaping the rewards of a long-standing partnership with Germany, which has resulted in more than one billion Euros in funding, including significant support for small-scale power plants and renewable energy projects. Holding sizeable potential for solar and wind energy development, Senegal serves as a regional leader in renewable deployment as a means of rural electrification.

Indeed, energy is a central component of poverty alleviation across Africa, with electricity access enabling greater independence, clean cooking and potable water, as well as dramatically improving the well-being of individuals, businesses and communities alike. Rural populations are cognizant of the challenges posed by a lack of stable electricity supply – increased urban migration, lack of access to basic services, low economic competitiveness, to name a few – and distributed renewables can represent the fastest and least expensive path to electrification.

European interest in Senegal has shed light on and served as a model for co-operation opportunities between renewable-rich African countries and developed partners, which offer cutting-edge technologies and technical expertise to transform raw resources into viable off-grid and mini-grid solutions.

Furthermore, while the cost of deploying renewable technology has never been lower, the availability of renewable-focused capital has never been higher. Investment in commercial and industrial solar has demonstrated resilience against the pandemic, continuing to be seen as a safe investment in light of rising utility costs and increasing distribution of both solar and financial technologies. Yet resource potential and low costs of equipment are not enough; Senegal and other resource-rich African nations require active investor interest and strong government support to unlock diversified energy mixes. In turn, a lack of investment represents a pointed threat to the achievement of long-term energy security.

“Young people and women have shown their great resilience, and it is our hope we close these deals in the renewable energy sector, Africans can have a sense of some hope that they will be included in the industry contracts and opportunities. It is no longer correct for the African to be the last hired and the first fired” Concluded Ayuk.