A worker checks the valve of an oil pipe at an oil field owned by Russian state-owned oil producer Bashneft near the village of Nikolo-Berezovka, northwest of Ufa, Bashkortostan, January 28, 2015. REUTERS/Sergei Karpukhin/File Photo

By TZ Business News Staff and Agencies.

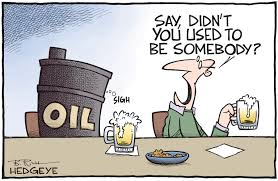

The US Dollar has firmed against other currencies around the globe this October, 2016, amid another simmering oil production war between the Organization of Petroleum Exporting Countries (OPEC) and US shale oil producers.

Analysts are cautioning in the meantime that the strengthening of the US dollar against other currencies will make crude oil imports slightly more costly. But it is unlikely that the announced cut in OPEC oil production cut will have any significant impact on the oil supply glut.

The value of the Euro currency dropped to its lowest level against the US dollar in almost three months this October and one foreign-exchange trader says it’s set to fall further.

The Foreign Exchange trading bank sees the European shared currency declining to $1.05 by year-end, more bearish than the $1.10 median estimate of analysts surveyed by Bloomberg News.

Oil prices are up about 13 percent since the Organization of the Petroleum Exporting Countries (OPEC) announced on Sept. 27 its first planned output cut in 8 years to rein in a global glut that halved prices from mid-2014 highs above $100 a barrel.

Oil rose earlier in the session after Russian Energy Minister Alexander Novak said he would make proposals to his counterpart from OPEC leader Saudi Arabia this weekend on price-supportive measures that could include an oil production freeze.

A rallying dollar limited oil’s advance though as greenback-denominated commodities, including oil, less affordable to holders of other currencies.

Oil prices dropped on Friday, October 21, dragged down by a stronger dollar. The dollar rose to its highest level since March against a basket of other leading currencies on Friday, potentially crimping demand as fuel becomes more expensive for countries using other currencies.

Oil prices dropped on Friday, October 21, dragged down by a stronger dollar. The dollar rose to its highest level since March against a basket of other leading currencies on Friday, potentially crimping demand as fuel becomes more expensive for countries using other currencies.

However, traders said there were signs that physical fuel markets were tightening after two years of ballooning oversupply, Reuters reports.

International Brent crude oil futures LCOc1 were down 19 cents, or 0.4 percent, at $51.19 per barrel. U.S. West Texas Intermediate (WTI) crude CLc1 was trading at $50.40 a barrel at 0208 GMT on Friday, down 23 cents, or 0.5 percent, from its last settlement.

Crude prices fell over 2 percent in the previous session on the back of the soaring dollar. Despite the falls, overall sentiment in physical oil markets was confident as signs of a tightening oil market mount.

“The near term fundamentals in the oil market have turned positive. Demand is stabilizing, OPEC production has peaked (and will fall if cuts are implemented), and global inventory declines imply that the market is more balanced than many believe,” Neil Beveridge of Bernstein Energy said in a note to clients.

The Organisation of the Petroleum Exporting Countries, OPEC, plans to implement a 0.5 to 1 million barrels per day production cut after a meeting on Nov. 30. OPEC’s current output stands at a record 33.6 million barrels per day.

Bernstein’s Beveridge said that due to OPEC’s cuts and general market conditions, he was “forecasting a return to $60 per barrel in 2017 and $70 per barrel in 2018”, adding that even higher prices would be prevented by rising production outside OPEC. “Ultimately, a rise in U.S. production (and non-OPEC supply more broadly) will cap the recovery in price,” he said.

U.S. crude oil production C-OUT-T-EIA has fallen almost 12 percent since peaks in 2015, to around 8.5 million barrels per day. But rising drilling activity has slightly lifted output again in recent weeks, in what some analysts say is an early indicator that the U.S. shale industry has adapted to lower prices and can operate at around $50 per barrel.

Oil prices drifted around unchanged on Friday, retreating from early highs after data showed the first double-digit growth in U.S. oil rigs since crude prices hit $50 a barrel.

A closely watched report from oil services firm Baker Hughes showed the number of active U.S. oil rigs rose by 11 this week, the 17th week without a decline in the rig count.

The last time U.S. oil rigs rose by 10 or more was two months ago, when there were 15 additions in the week of Aug. 15 and 10 in the week of Aug. 19. U.S. crude prices then ranged between $44 and $48.

In Friday’s session, U.S. West Texas Intermediate crude CLc1 was up 1 cent at $50.64 a barrel. The session high was above $51. Brent crude LCOc1 showed a 25-cents gain at $51.61, after a session peak at $51.89.

“This is what we’ve been anticipating. With prices at these levels and rising, rig count increases will likely be in the double digits hereon,” said Tariq Zahir, crude trader at Tyche Capital Advisors in New York.

Some traders and analysts have warned for weeks that U.S. shale oil drillers, responsible for much of the worldwide crude glut of the past two years, were likely to ramp up activity with WTI back at above $50 from 12-year lows of around $26 in February.

“The day’s still young,” said Donald Morton, who runs an energy-trading desk at Herbert J. Sims & Co in Fairfield, Connecticut, after the Baker Hughes data. “Don’t be surprised if this market finishes 30 or 40 cents down towards the end.”