The International Consortium of Investigative Journalists (ICIJ) has established links between Congo DRC President Joseph Kabila’s right hand man Augustin Katumba Mwanke to suspected corruption money from the Canadian copper mining company Glencore using an Israeli middle man.

Tax Justice Network (TJN) has in the meantime reacted to Paradise Papers revelations by asking the United nations UN) to convene a global summit to end tax abuse and financial crime.

By TZ Business News Staff and Agencies.

Investigations have linked President Joseph Kabila’s Government in Congo DRC to suspected corruption leading to the plunder of diamonds and copper by the Canadian company Glencore in the DRC, according to findings published by the International Consortium of Investigative Journalists (ICIJ).

The findings published on Sunday, November 5, 2017 suggest that the foreign company could get access to top Government officials who decide on resource allocation through the righthand man Augustin Katumba Mwanke with the link to the Canadian multi-national made through the Israeli middle man named Dan Gertler.

The ICIJ investigations report launched Sunday, which come out as a sequel to the famous Pamana Papers marks an all new global investigation into the financial secrets of the rich and powerful. The ICIJ have called their latest investigation “The Paradise Papers”. (Editor’s Note: The original report does not link President Joseph Kabila as a person to corruption as implied in the first version of this synoptic report).

Together with the German publication Süddeutsche Zeitung and 94 other media partners, the consortium of investigative reporters sifted through more than 13.4 million leaked files that come from the prestigious offshore law firm Appleby; a smaller, family-owned trust company Asiaciti and from company registries of 19 secrecy jurisdictions.

The year-long investigation exposes offshore interest and activities of more than 120 politicians and world leaders.

Findings on Congo DRC suggest that Mr. Dan Gertler, the Israeli masquerading as an independent businessman running a company different from Glencore, received USD 45 million from Glencore as if it were a loan, but the amount may have been used to bribe top DRC officials in exchange for favors in a copper mining agreement.

Glencore held shares in the Katanga open-pit copper mine. Gertler also owned some shares in the company through a Trust. The DRC Government, through its state-owned mining company, demanded the re-negotiating of royalty payments in the production sharing agreements which would lead to payment to government of amounts totaling $585 million.

After getting the USD 45 million ‘loan’ from Glencore, findings from leaked documents indicate there was a secret understanding between Glencore and the Israeli middle-man that $45 million would be associated with ‘negotiating’ the $585 million government demand downwards. The report reads in part:

Under the leadership of President Joseph Kabila, the DRC set up a panel to review mining contracts with foreign companies. The review spread confusion through corporate headquarters in Europe, Asia and the Americas, including the offices of Katanga Mining Ltd.

The Canadian-headquartered mining company held rights to valuable copper deposits in the DRC, and Glencore, already a Katanga shareholder, was eying the mine with ever greater enthusiasm.

By early 2008, with the DRC’s contract review looming and with hundreds of millions of dollars in investment at stake, Katanga and its shareholders had to act.

Months later, however, the DRC state mining company that negotiated mining contracts with private investors began to insist on changes to Katanga’s proposals as to how the mine would be run. The Congolese government mining company made a series of counterproposals that were “quite unacceptable,” the Katanga board agreed at a June 2008 meeting.

“Dan Gertler, who had a substantial indirect interest in the Company, should be given a mandate from the Board to negotiate with the DRC authorities,” Katanga’s board agreed at the June 23 lunchtime meeting, held at the Hilton hotel by the Zurich airport. Among the Katanga board members was Glencore shareholder and director Aristotelis Mistakidis.

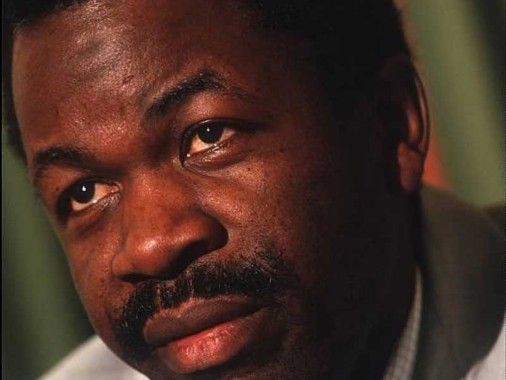

Gertler, an Israeli diamond and copper dealer who held his shares in Katanga through an offshore trust, was well-connected in the DRC. He was particularly close to President Kabila’s righthand man, Augustin Katumba Mwanke. Lawyers for Gertler told ICIJ that the two men only became acquainted “on a personal basis” after Katumba’s retirement from government.

Known to many Congolese as “God the Father,” Katumba was also known as the man to see for anyone seeking access to the DRC’s enormous natural resources reserves.

Years later, in 2013, an expert panel led by former U.N. Secretary-General Kofi Annan alleged in a report that Gertler’s companies had acquired mining assets from the DRC for an average of one-sixth of their commercial value.

Gertler’s lawyers told ICIJ that he denied allegations in the 2001 U.N. reports and that he had not been given an opportunity to comment before publication. The United Nations has not cited him since 2001, his lawyers said. Gertler’s lawyers told ICIJ that his companies were not given the opportunity to respond to allegations made in the 2013 report, allegations that the companies “categorically refute.”

“Mr Dan Gertler is a respectable businessman who contributes the vast majority of his wealth and time to the needy and to different communities amounting to huge sums of money,” his lawyers told ICIJ. “He transacts business fairly and honestly and strictly according to the law.”

Soon after the June 2008 agreement in Zurich to enlist Gertler, Katanga celebrated some good news. “Dan Gertler had fulfilled his mandate very well,” the company’s outgoing CEO told the board of directors in a conference call a month later, according to Appleby’s internal files. “The meetings over the last 2 days had been extremely productive.”

A new memorandum of understanding called for an additional $10 million in future royalties to be paid the government, but, all in all, Katanga’s board expressed its approval of the agreement.

In October 2008, Glencore appointed a Glencore managing director, Steven Isaacs, interim CEO of Katanga. And soon, the DRC’s state mining company was back with more demands, including “additional monies” totaling $585 million for a signing bonus.

In October 2008, Glencore appointed a Glencore managing director, Steven Isaacs, interim CEO of Katanga. And soon, the DRC’s state mining company was back with more demands, including “additional monies” totaling $585 million for a signing bonus.

To resolve this “vitally important matter,” the board decided that four Katanga directors, including Isaacs and Mistakidis, “would have a discussion with Dan Gertler” again.

As the directors worried over the government’s demands for more money, the company was hurting for cash. Records show Katanga was seeking money from potential investors to help it continue trading. Then a windfall came through.

Gertler was successful in pulling this government demand down after getting his ‘loan’. Some meetings were ‘ held in a hotel in Zurich, Switzerland.

Two months after an agreement with the Government was reached, the Katanga copper mine CEO announced in a board meeting that he had met with Gertler in Kinshasa, the Congo DRC capital. “As a result . . . revised proposals were made by Katanga which has resulted in the resolution of most issues” with DRC authorities, according to the minutes of the board meeting.

Not only was the deal moving ahead, the CEO said, but Katanga had ‘persuaded’ the DRC to accept a signing bonus worth $140 million, instead of more than $580 million. The reduced bonus meant that Katanga would pay one quarter of what almost all other mining companies would have paid, on average, per ton of copper at the time, according to Elisabeth Caesens, an expert in Congolese mining deals who reviewed the leaked documents.

The Katanga-DRC deal was inked in July 2009, weeks after Glencore had increased its stake in Katanga again, to near total control. “The documents reveal that if Gertler failed to get that contract amended, Glencore could have demanded immediate repayment of the $45 million loan,” Caesens said. Read original Report here.

The Tax Justice Network (TJN) has in the meantime reacted to Paradise Paper revelations by asking the United Nations (UN) to convene a global summit to end tax abuse and financial crime.

The ‘Paradise Papers’ have once again highlighted the failure of governments around the world to deal with the scourge of tax dodging and financial crime facilitated by offshore financial centres, and we commend the ICIJ on their fearless investigative journalism.

The Tax Justice Network is calling on world leaders to commit finally to ending tax abuse and financial secrecy. The United Nations should convene a summit of world leaders with the goal of agreeing a UN convention to end tax abuse and financial secrecy. World leaders need to agree binding targets to reduce all forms of illicit financial flows, with accountability mechanisms to ensure progress.

Research from the Tax Justice Network shows that the level of profit shifting by multinational companies has exploded over the last decade. The latest estimates show that world governments are losing $500bn a year in taxes due to tax avoidance by large companies. A further $200bn a year is estimated to be lost due to the undeclared offshore wealth of tax evading individuals.

The Paradise Papers is the largest leak of data to date from the world of financial secrecy. And once again, the leaks confirm that this is not a marginal activity, but a systemic, global issue. Major corporations and wealthy elites are dodging taxes – and their obligations to society – with impunity, supported by the biggest banks, accountants and lawyers.

Nor are these victimless crimes – far from it. These truly anti-social actions undermine public health and education systems, and drive inequality and corruption – leaving the poorest families and the poorest countries of the world to suffer. Tax Justice Network research confirms that lower-income countries bear a disproportionate share of the burden from global tax abuse – and this has direct costs in terms of everything from foregone economic growth to excess child mortality.

In response to the leaks Alex Cobham, Chief Executive of the Tax Justice Network said:

“These leaks confirm the systemic nature of tax abuse and corrupt practices, with global financial secrecy being marketed by major law firms, banks and accounting firms. Government efforts to combat this problem have been piecemeal at best. And that is why the Tax Justice Network is today calling for a genuinely global response.

“World leaders need to seize the moment and convene at the UN to agree a path to ending financial secrecy and tax abuse for good. And we, as citizens of the world, must demand this from our elected representatives. Otherwise we may as well just sit and wait for the next leak – because those profiting from these anti-social practices will never stop on their own.”