…. as Nations Produce to Sell Bellow Production Cost.

. The tumbling oil prices will result in far-reaching consequences around the world, with the potential to destabilize regimes, remake regions and alter the global economy in ways unforeseen.

. The only flicker of distant hope for a price rebound that exists is toward the end of year 2016…if the global economy starts recovering from stagnation

. Neighbouring Uganda seen to have discovered oil at the wrong time!

By TZ Business News Staff and Agencies

Weekly world oil price reports spread false hope at times, according to analysts. The Azerbaijan business website ‘ABC.com’ reported during the week ending January 22, 2016 the American oil price benchmark WTI was quoted at $32.19 a barrel, while European Brent blend was traded at $32.18 a barrel.

On a weekly basis, the figures represented a marginal price increase during a week in which quotations had dived below $27 a barrel, destroying more and more new producers from the market; producers who were unable to make profit from low prices through-out 2015. The website reports 5-6 countries are currently selling their crude oil below prime cost.

Some experts attribute the slump to correction of the markets after a bullish trend of the last decades while others see a proxy-war between the U.S. with Russia behind the scenes of market trends. Whatever the explanation, however, the year 2016 looks pretty gloomy. ABC.com says the Azerbaijani government price forecast of $25 a barrel for 2016 may in fact be rather optimistic.

The Forbes analyst Gaurav Sharma argues that fundamentals which brought the market where it is have not exactly changed. Writing in first person, the analyst says Given the extreme levels of volatility in the oil market at present, percentage drops and upticks in front-month futures prices have begun to seem daft.

With both Brent and WTI trading around historic 12-year lows and lurking either side of $30 per barrel level these percentages are relatively meaningless. A rise or drop of $2 triggers 5-6% gains or losses intraday, with headlines based on the movements proclaiming a bullish rally or a bearish mauling sounding just as phoney. The only percentage worth remembering is that oil ended 2015 over 36% lower than the year before.

As further volatility for the next six months is inevitable, we should not lose sight of one crucial factor in the ongoing melee – oil market fundamentals have not materially altered.

Addressing the oversupply argument first, I see Iran as the only producer that would make an addition to the global supply pool over the next 12 months based on current market intelligence from physical crude traders and ship brokers.

The country’s government claims it will raise production by 500,000 barrels per day in a matter of months; a highly improbable figure given Iran’s dire need for infrastructural investment. Even if Iran manages to up its production rate by half the stated amount to add to its current 2 million bpd plus headline crude production, then it will be some achievement. Furthermore, Iranian production growth is highly unlikely to rise to 400,000 bpd before 12 to 15 months.

Higher Iraqi and Saudi production volumes, and exports by both countries to the US Gulf coast have already been factored into the market’s thinking from the solver-modelling of physical buyers enjoying low prices to the paper traders in a net-short mind-set driving them on. Libyan crude additions, while hard to predict given the security situation in the country, would still be random and relatively less worrying for the market.

Yet, at the same time, I fully expect non-OPEC production to decline between now and June, more so as hedging strategies in place at smaller independents start rolling off. High risk/reward premised second tier oil and gas plays from Uganda to Trinidad managed by smallcaps, many of whom are listed on the Toronto Stock Exchange andLondon Stock Exchange ’s Alternative Investment Market, will see their operating risks stack up heightened by lower oil prices and rewards diminish.

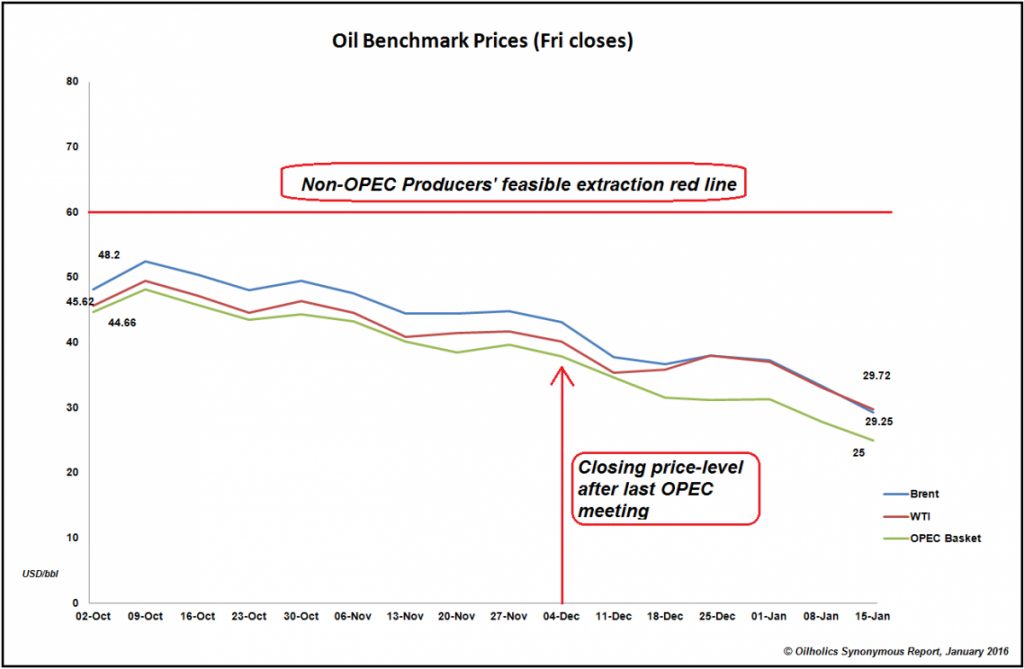

For most non-OPEC plays $60 per barrel remains the optimum price (see chart) while some unconventional plays need a three-figure price. An almighty push by the industry towards operational efficiencies when oil fell to $50 per barrel kept many going, but most are not designed to cope with a drop to $30; a level that is hurting even Middle Eastern producers with far lower labor costs.

US producers – including shale players – are running out of ideas at $30 as well, with the Energy Information Administration now predicting a headline oil production decline of 570,000 barrels per day over the course of this year. Of course, acceleration of distress will not be uniform across Permian, Bakken and Eagle Ford, with the latter probably suffering the lowest rate of decline.

However, a supply correction is inevitable and will become more pronounced over the next six months. Switching to demand fundamentals, trepidation over China’s economic prospects, even if not misplaced, is nothing new and does not merit the kind of bearish mauling oil futures have received for the first three weeks of 2016.

Indeed, what the International Monetary Fund recently described as the ‘new normal’ for China, i.e. a lower 6.5% to 6.8% growth rate driven by domestic consumption, is something many nations would gladly accept. In 2015, for 11 out 12 months, China’s crude importation levels stayed within the established average range of 6.7 million bpd, with Reuters’ data indicating the figure was as high as 7.82 million bpd in December.

If the Chinese are in a state of wholesale retreat from the oil markets where is the evidence? Quite the contrary, Beijing is going full steam ahead in establishing a US-style strategic petroleum reserve and cracking crude in ever greater volumes for petroleum product exports to near Asia. In fact, China’s fuel exports alone rose 21.9% on an annualized basis to a record 693,300 bpd last year.

The Website ‘Politico’ has in the meantime said tumbling oil prices will result in far-reaching consequences around the world, with the potential to destabilize regimes, remake regions and alter the global economy in unforeseen ways.

The drop in oil prices will be one of the most important issues in 2016 and will have consequences both for the global economy and politics, John McLaughlin, distinguished practitioner-in-residence at Johns Hopkins University at the Paul H. Nitze School of Advanced International Studies, said.

A group of prominent experts on energy, economics and geopolitics told Politico about the aftershocks the world should be bracing for due to the falling oil prices.

Terry Lynn Karl, professor of Political Science at Stanford University, noted that there are two volatile scenarios that lie ahead and “neither is promising.” On the one hand, oil prices are likely to stay unacceptably low through 2016. On the other, “today’s bust is likely to lay the basis for a sharp price spike down the road.

“Despite all the current hype, only a relatively thin margin separates surplus from shortage. Global crude oil production has already dropped substantially, with U.S production falling to 2008 levels. […] And widespread conflict in oil regions—exacerbated by low and unstable oil prices—could significantly disrupt supply at almost any time,” the analyst said.

According to co-director of the Institute for the Analysis of Global Security Gal Luft, the current situation is unlikely to last for long. Oil prices may jump again as they did between 1998 and 2008 if the global economy starts recovering from stagnation.

Ian Bremmer, president of the Eurasia Group, said that the impact of low oil prices will be concentrated in the Middle East where “political structures are brittle and based on oil wealth-supported patronage.”

“Across the region, there are immediate and direct security threats without any social, political or economic reform processes in place to address the challenges these regimes face from the inside. What keeps these countries together — as well as those that rely on them for support — when the oil money runs out?” the analyst told Politico. He added that the US, China and Japan would benefit the most from the situation, while Europe not so much.