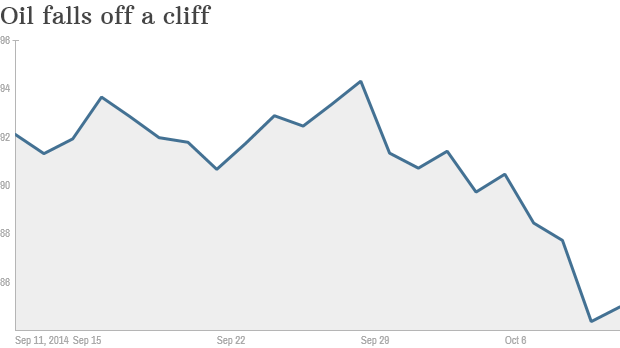

Crude oil tumbled below $84 a barrel in early October, 2014 for the first time since the 2012 Olympics in London. If you have a car or truck, you’re probably cheering. But here’s why you should also be worried.

Cheap oil prices are largely a reflection of some pretty scary developments in the global economy, especially in Europe. No one wants to see another recession.

The oil plunge is spooking investors, helping to fuel some of the recent extreme turbulence on Wall Street. The current situation is a reminder that you should be careful what you wish for. Sure, consumers and businesses will benefit from friendlier prices at the pump. But it’s being driven at least partially by negative factors.

“Energy was a star performer January through June. Now it’s taking all the air out of the market,” said Joe Saluzzi, co-head of trading at Themis Trading.

Trouble in Europe and China

A confluence of factors have teamed up to open a trapdoor beneath the price of oil. First, there are mounting worries about Europe’s anaemic economy and the ability of Super Mario and the European Central Bank to continue propping it up.

Germany is teetering on the brink of recession, sending its stock market to one-year lows. Shrinking economic activity in Europe and continued sluggishness in China translates to less demand for commodities, especially oil. Obviously, that’s a big negative for oil prices.

Second, oil has been hurt by the resurgent U.S. dollar. Commodities frequently move in the opposite direction of the greenback, which is enjoying one of its best stretches in recent memory as the U.S. economy outperforms.

No supply shortages in U.S.

The other often overlooked driver of lower energy prices is swelling supplies. U.S. oil production, fuelled by the shale boom, is skyrocketing. Domestic output has spiked about 70% since 2008, according to the Energy Information Administration.

Surging U.S. output is a “supply-side shock,” Marc Chandler, global head of currency strategy at Brown Brothers Harriman, wrote in a note to clients.

That helps explain why the average price of gas in the U.S. has dropped to $3.24 per gallon, compared with $3.43 a month ago, according to the AAA Fuel Gauge Report. Some states like Missouri, South Carolina and Tennessee are already flirting with $3 per gallon gas.

But it’s not just the U.S. that’s keeping prices low. Instead of dialing back on output to offset sinking prices, Saudi Arabia is actually ramping up production in an apparent effort to maintain overall revenues. It’s also having the side effect of putting pressure on Russia, which relies heavily on oil revenue as well.

While Bloomberg reports that domestic fields will add “an unprecedented 1.1 million barrels a day of output,” while consumption is expected to shrink to its lowest level since 2012, the New York Times insists that a crude oil tanker that left Texas in late July, bound for South Korea, is a sign of the changing times.

Stock market jitters

No matter the cause, the result is clear: energy stocks are getting burned. Just look at Thursday, when the S&P 500 basket of energy stocks careened 3.7%. The energy group wasn’t just the worst performer on Thursday. It’s the biggest loser this month and for the year as well.

Exploration companies, which rely on lofty prices to justify expensive discovery efforts, are really taking it on the chin. Three of the four worst performing S&P 500 stocks in 2014 are energy exploration companies: Noble Corporation, Transocean and Diamond Offshore Drilling.

Red ink is really drowning smaller energy stocks, which by definition are riskier and more susceptible to wild swings driven by oil prices. The Russell 2000 Energy index plummeted 6% on Thursday — a dramatic move for a sub-index. It’s down a whopping 26% over just the past month.

This experience highlights how different asset classes are interconnected. Selling in one corner of the market can quickly spill over into another, unrelated corner.

“Oil is lower… that should help consumers but consumer stocks are owned by the same guys (read: everyone) who is getting dinged by energy stocks,” Michael Block, chief strategist at Rhino Trading Partners, wrote in a note on Friday. “Risk management is fun for the whole family.”

The tanker, Singapore-flagged and leaving quietly from the port in Galveston, Texas, was carrying 400,000 barrels of crude oil and was apparently the first “unrestricted export of American oil to a country outside of North America in nearly four decades.”

Now oil prices are falling. The two oil stories are certainly related—even if there is a months-long gap in the timing. West Texas Intermediate crude, the US benchmark, is down 24% since mid-June, and on 2 October, it fell below $90 per barrel for the first time in 17 months.

Drillers are panicking over the specter of declining operating capital, and being able to export crude is the only outlet if oil prices continue to fall, while demand weakens.

”If prices go to $80 or lower, which I think is possible, then we are going to see a reduction in drilling activity,” Bloomberg quoted Ralph Eads, vice chairman and global head of energy investment banking at Jefferies LLC, as saying. “It will be uncharted territory.”

Ben van Beurden, CEO of Shell, isn’t buying into the panic, however. He says he is confident that oil will return to “very robust” pricing in the long-term.

Others are banking on a particularly harsh winter, supply cuts from OPEC countries, and continued geopolitical volatility in the Middle East and North Africa to bring oil prices back towards $100 a barrel.

For those not eyeing the prospects of freezing and conflict, though, exports are the saving grace.

And as the Wall Street Journal reports, “the share-price boom at U.S. energy firms has gone bust, due to slumping global growth and tumbling crude prices.”

Rex Tillerson, ExxonMobil’s CEO, says the ban on exports of US crude oil—which grew out of the oil shortages suffered by the United States in the 1970s–is no longer necessary.

The export of oil to South Korea “symbolizes a new era in US energy and US energy relations with the rest of the world,” NYT quoted energy historian Daniel Yergin as saying.

Under the ban of crude exports, refineries benefit from the processing largesse, but there is growing support to lift this ban in a changing world—and in light of the shale revolution, which has led to an increase in drilling by around 70% over the past six year.

While supporters of the ban say that crude exports could lead to a rise in gasoline prices and heating costs, critics of the ban say it would help stabilize oil prices.

The next word on the issue will come in about a month, when the Energy Information Administration (EIA) releases a much-anticipated report on the potential impact of lifting the ban. It won’t be the final word, but it is expected to determine the shape of this debate and to significantly influence its outcome at a time when oil prices are tumbling and confidence of a rebound is shaky.