This is an interview done in Cape Town this week between This is Africa and the SABMiller Chief Executive Officer for the Africa region, Mark Bowman, on the subject we had covered earlier–the subject of SABMiller’s effort to penetrate the low income beer drinkers segment in all of Africa–through the introduction of cheaper beer.

The Earlier Story Follows

By TZ Business News Staff.

South Africa’s SABMiller breweries, majority shareholders in Tanzania Breweries Limited (TBL), are reportedly still planning to penetrate the low income segment in all of Africa through the introduction of cheaper beer, according to ‘This is Africa’, a publication associated with the London Financial Times. But reports in the British Telegraph newspaper indicate this plan has been in the making since 2009.

SABMiller, the world’s second largest brewing company, is to adopt a new strategy targeting low income consumers in all of Africa, the report says.

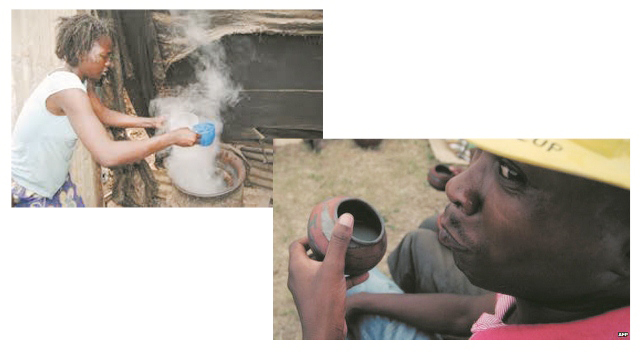

The brewer wants to compete head-on with traditional brewers to tap revenue traditionally the exclusive domain of home-made Tanzanian brands like wanzuki, komoni, lubisi, kindi, kangala, ulanzi and mnazi.

Mirroring strategies in other sectors targeting the untapped commercial potential of ‘bottom of the pyramid’ consumers, the company will focus on creating a differentiated pricing model to protect affordability for its lower cost lines rather than keeping pace with inflation, This is Africa reports.

SAB Miller executives hope this scheme will allow them to capture the market currently dominated by informal alcohol producers.

“The key difference between Africa and the rest of the world is the large volume of informal alcohol – this is an opportunity,” says Mark Bowman, the company’s managing director for Africa.

In other sectors, companies such as pharma giant GlaxoSmithKline (GSK) have adopted similar [economies of scale] volume-based strategies for products in African markets in order to increase affordability.

While investors continue to target new products and services at Africa’s growing middle classes – whose numbers have increased from an estimated 4.6 million to 15 million between 2000 and 2014 in 15 key economies, according to a recent study – interest in catering to the region’s large low income population is also growing target.

More than 4 billion people, or 72 percent of populations across the emerging regions of Africa, Asia, Eastern Europe, and Latin America and the Caribbean, are considered bottom of the pyramid consumers, according to the IFC.

Typically these segments are underserved and reliant on informal markets. However, designing products and services at appropriate price points while still allowing companies to make a profit can often be challenging using orthodox strategies.

SAB Miller’s growth by volume in Africa outpaced Asia Pacific in the third quarter of 2014, indicating the growing importance of the market. However aside from Uganda, where SAB Miller’s affordable product lines constitute 60 percent of the company’s sales volume – the company’s inroads into low income markets remains underdeveloped, according to Mr Bowman. It is this fact that the new strategy is designed to remedy.

“We would probably be a little bit uncomfortable if that were the case across the whole of Africa, but logically if it makes sense given the the price point that you would sell one and a half to two times more affordable beer than mainstream. I think the problem is our own psyche around this thing,” he says, pointing out that beer at $1 still constitutes a premium product in this part of the world.

However, as the company shifts its mentality around the new approach, it will seek to grow this segment “as aggressively as we can…as long as we can preserve reasonable growth and not cannibalize unnecessarily established positions” Mr Bowman says. According to Bowman, this will mean pricing at approximately 60 to 90 percent of inflation depending on the market, as opposed to the standard 90 to 100 percent now.

The company has already implemented differentiated pricing in South Africa, one of its key markets. Low pricing regimes are expected to be applied in approximately 70 percent of SAB Miller’s African markets.

According to Mr Bowman, a focus on improving efficiency and shifting focus away from focusing on margins will be key to the new approach.

“Our focus now is on how many dollars we can make, or local currency equivalent, as opposed to exactly the margin. I would say on an annual basis if we were neutral to slightly positive in terms of margins we would be happy – so the emphasis has moved away from the margin.”

In 2009, a SABMiller chief executive named Graham Mackay was quoted as this project would be done in “enlightened self-interest”. SAB intends to use cassava, a tuber, to help brew beer, commercialising a technique used across Africa for generations.

In a hangover from colonial times, commercially produced beer in Africa has typically been brewed using barley and maize imported from Europe or the US. On average 88pc of the input value of a bottle of beer is imported, of which 65pc is agricultural costs. The result is high prices, explains Mark Bowman, head of SAB’s African operations.

“Beer is still very much an ‘introduced’ product in Africa and as such it comes with European input costs,” says Bowman, pointing out that cassava is about 60pc of the price of maize. “The overall strategy is to reduce the cost of beer so that we can reduce the price of beer.”

SAB plans to use cassava – a rich form of starch – to replace maize, allowing the company to brew pilsener style lager using 60pc barley and 40pc cassava.

The company’s first move into cassava-based beer will be made from its brewery in Luanda, on the coast of Angola, where it plans to brew local brand N’Gola using the crop. Maize will gradually be phased out of the brewery and replaced by cassava, explains Gerry van den Houten, supply chain and enterprise development director for SABMiller in Africa, who is running the project.

“With cassava beer we are trying to aim at consumers who aren’t drinking beer at all but who are drinking a whole lot of other stuff,” says Van den Houten.

The use of different types of crops to make beer is far from a radical new idea. SABMiller and Diageo have been brewing beer in Africa using sorghum for some years. In Nigeria one third of all beer is brewed using the grain. SAB’s sorghum-based Eagle brand sells for about 85pc of the price of standard lager in Uganda.