China’s National Development and Reform Council – which oversees macroeconomic planning and is guiding the restructure of China’s economy – has set a target of $113bn in non-financial outbound FDI for 2015, against actual outflows of $103bn in 2014. African interests form a fundamental part of this strategy….

By ADRIENNE KLASA.

China lowered its 2015 growth projections to “around 7 percent” on 5 March – the slowest rate in 24 years – amid fears that a slowdown in the Asian powerhouse could dampen economic ties with Africa.

But while demand for commodities – which formed the basis of the China-Africa relationship so far – is set to slow, outward foreign direct investment (OFDI) trends on the back of China’s ‘New Silk Road’ grand strategy indicates that China’s focus on Africa is here for the long haul, according to analysis by South Africa’s Standard Bank.

Chinese growth was projected to hit 7.4 percent through 2015 before the downward revision was announced by Premier Li Keqiang. China’s economic fortunes are intimately tied to the ascendance of many African economies over the past decade. African commodities played a significant role in fuelling China’s average of 10 percent growth over the past five years, supplying raw materials for manufacturing and a booming real estate market.

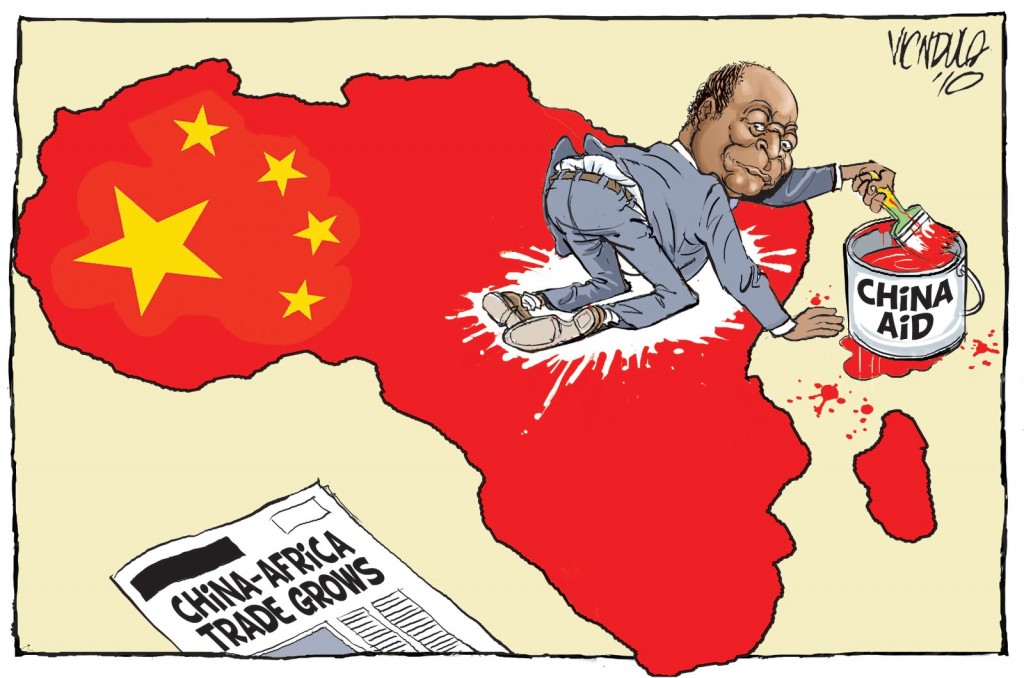

In turn, Chinese investment flows played a role in buoying high growth rates across Africa, with economies ranging from Ethiopia to Rwanda, Democratic Republic of Congo and Mozambique growing at over 8 percent annually. However China’s relationship with African countries has often be subject to controversy – both domestically within African nations and in the West – and is often characterised as opaque.

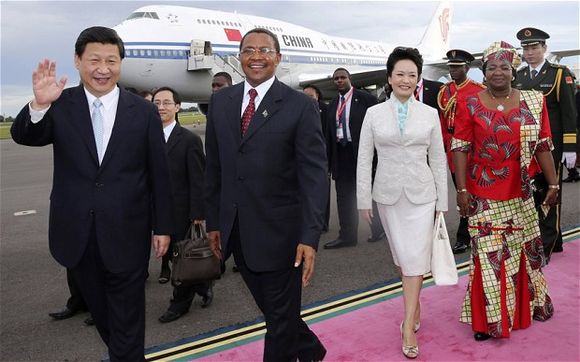

Tanzania President, Jakaya Mrisho Kikwete welcomes Chinese president Xi Jinping during a recent visit to Tanzania

But while the structure of China’s economy is changing as it matures away from high growth driven by cheap labour and the so-called ‘housing bubble’, its geographic focus for investment is unlikely to.

“China is going to become an increasingly important capital exporting country in coming years, which is likely to drive further investment in African mining,” says Dr George Fang, Standard Bank’s Beijing-based head of mining and metals in Asia.

While China’s many state-owned enterprises (SOEs) have led the way for Chinese outward investment, private enterprises are increasingly looking abroad for opportunities as well. Outside of the financial sector, private companies now comprise more than 37 percent of China’s outward FDI.

Currently, more than 2500 Chinese companies have operations in Africa – a number that is set to increase. The domestic slowdown in China also provides an incentive to shift even more of their interests overseas in search of higher returns.

China surpassed the US as the continent’s leading trade partner in 2009, while its FDI stock grew at an annual rate of 53 percent between 2001 and 2012. Total Chinese FDI flows into sub-Saharan Africa during this period are estimated at $18.19bn, dwarfing those from the US.

While the US has experienced some rebound in growth following the 2008 financial crisis, China’s industrial production descended to a six year low in 2014. Retail sales – an indicator used to gauge consumption – also underperformed, coming in at 11.9 percent against a 13 percent target set by the country’s planning agency.

But despite these indicators and the collapse of a so-called ‘real estate bubble’ expected to depress demand for raw materials for domestic consumption, Chinese companies’ outbound merger and acquisition activity has risen rapidly – amounting to a compounded annual increase of more than 33 percent since 2004.

China’s National Development and Reform Council – which oversees macroeconomic planning and is guiding the restructure of China’s economy – has set a target of $113bn in non-financial outbound FDI for 2015, against actual outflows of $103bn in 2014.

African interests form a fundamental part of this strategy, as outlined in the government’s New Silk Road master plan, which envisages networks of trading routes and influence stretching from China through central Asia and the Middle East to Europe, with maritime links running along the eastern coast of Africa and the Gulf of Aden into the Red Sea. Africa is specifically referred to as both a conduit and a destination in China’s vision.

While some of the parameters of this ambitious plan remain amorphous – including whether these relationships will be cemented through bilateral agreements or other mechanisms – it is clear that China intends to reclaim its identity as the “Middle Kingdom”, a global hub for economic and intellectual exchange.

“China has been rapidly expanding its global footprint via international acquisitions as it gradually evolves into a capital exporting country,” says Dr Fang.

“Chinese interests are clearly set on a path of one road, one belt and now we could add ‘one continent’,” he continues, referring to the motto used by the Chinese government to refer to the New Silk Road strategy. “In fact, China’s investment in Africa is already well down the road and it is not just about resources.” Source: This is Africa, Business Section

A DIFFERENT VIEW OF CHINA IS PRESENTED HERE: