A flicker of hope for a crude oil price rebound in mid January, but experts say it is “sentiment driven.”

In Kuwait some experts are suggesting the price may rebound back to $80-$85 levels per barrel within 2015.

Iran’s military affairs news agency, FARS News Agency, reported during the week ending January 17, 2015 that the country’s Minister of the Economy, Ali Tayyebnia said in Tehran his country’s economy is powerful enough to win the battle against falling crude prices.

In December [2014], the Speaker of the Iranian Parliament Ali Larijani said exports of crude is just one of Iran’s sources of revenue and the country can live up without oil sales and through exports of its rich mineral resources, modern industries, and talented people.

But Iran is pleading with Saudi Arabia to help stop the continuous slump in oil prices in order to protect the economies of the region’s oil producing countries, according to India TV which quotes the Chinese News Agency, Xhinua . Saudi Arabia, the biggest oil exporter within the OPEC, has ignored Iran’s call to cut oil output and oil prices have continued to tumble, falling almost 50 per cent to below $50 per barrel in recent weeks.

The website worldbulletin.net says the sharp decrease in international oil prices has forced Iran to lower the crude oil price budgetary speculation to $40 per barrel for the new Persian year which starts from March 21.

Iranian Finance and Economy Minister Ali Tayebnia announced this change [last] Thursday during his visit to Qom city located in the south of Tehran.

“We need to reduce our dependence on oil revenues and prepare ourselves for practicing a better resistance economy,” Tayebnia said during his meeting with highly influential Iranian Shia clergies, Islamic Republic News Agency reports in a story reproduced by worldbulletin.net. Iran had earlier fixed the crude oil price at $72 in its budget draft.

Sanctions and drops in oil prices have affected Iranian oil exports and the country’s revenues, especially since President Hassan Rouhani took his office 17 months ago.

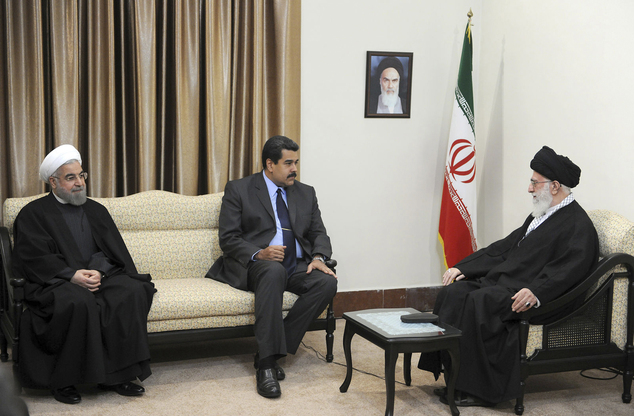

Reuters News agency said in a recent report Iran’s supreme leader Ayatollah Ali Khamenei told Venezuela’s president he backed coordinated action between Tehran and Caracas to reverse a rapid fall in global oil prices which he described as a “political ploy hatched by common enemies”.

President Nicholas Maduro was on a tour of fellow OPEC countries to lobby for higher oil prices, which hit new lows [in mid January 2015] at below $50 per barrel, nearly half of what they were back in June 2014. The plunge in crude prices has pummelled the public finances of Iran and Venezuela, whose economies rely heavily on oil exports.

In this picture released by the official website of the office of the Iranian Supreme Leader Ayatollah Ali Khamenei (R), with Venezuelan President Nicolas Maduro (C) as Iranian President Hassan Rouhani sits next to them at Ayatollah Khamenei’s residence in Tehran, Iran, on Saturday, Jan. 10, 2015. A portrait of the late Iranian revolutionary founder Ayatollah Khomeini hangs on the wall. Both countries have vowed to work together to stabilize falling global oil prices. (AP Photo/Office of the Iranian Supreme Leader)

“The strange drop in oil prices in such a short time is a political ploy and unrelated to the market. Our common enemies are using oil as a political ploy and they definitely have a role in this severe fall in prices,” Khamenei said in talks with Maduro.

“(Khamenei) endorsed an agreement between the presidents of Iran and Venezuela for a coordinated campaign against the slide in oil prices”, the official IRNA news agency said.

Venezuela’s economy contracted in the first three quarters of 2014 and its international reserves have deteriorated sharply due to the tumbling oil prices. The decline has spurred concerns that Venezuela may default on its foreign bonds, which in turn has pushed its bond yields to the highest of any emerging market nation. Maduro has denied his country will default.

Earlier that week, Iranian President Hassan Rouhani said OPEC members Iran and Venezuela “can undoubtedly cooperate to thwart world powers’ strategies … and to stabilise prices at a reasonable level in 2015”.

Already hit by global sanctions over its suspected nuclear programme, Iran has been particularly frustrated by the failure of OPEC countries – led by its arch regional rival Saudi Arabia – to cut output to ease the existing glut in the oil market.

At its previous meeting on Nov. 27, the cartel decided to keep output at 30 million barrels per day. Saudi Arabia blamed the weak market on oversupply by non-OPEC producers such as Russia, Mexico, Kazakhstan and the United States. OPEC is due to meet next in June.

In saying Iran’s economy is powerful enough to win the battle against falling crude prices, Iran’s Economy Minister Ali Tayyebnia also made the following remarks: “The government’s plan is that it envisages different scenarios with regard to oil price and prepares itself for any rate,” adding that there has never been any clear forecast of oil prices since the government started drafting its annual budget.

The International Energy Agency (IEA) has in the meatime predicted that oil prices may increase in the second half of the year.

In December 2014, the Iranian Parliament Speaker Ali Larijani said exports of crude is just one of Iran’s sources of revenue and the country can live up without oil sales and through exports of its rich mineral resources, modern industries, and talented people.

“We have different methods and scenarios to run the country under different circumstances and we will not forget which countries are conspiring to reduce oil prices,” Larijani said, adding that it is the same countries which conspired against Iran in the 1980s when Iran was at war with Iraq.

“It would be a mistake if they (certain governments) imagine that they can change the strategic situation of the (Middle East) region through oil (price),” said Larijani.

In early March 2014, Supreme Leader of the Islamic Revolution Ayatollah Seyed Ali Khamenei in a meeting with economic activists, elites and state officials in Tehran explained the root cause of Iran’s turn to the Resistance Economy as well as the specifications, features and components of such an economic model.

Ayatollah Khamenei elaborated on the reasons and incentives for the adoption of the economy of resistance, and said, “Abundant material and non-material capacities of the country, treatment of chronic and lasting economic problems, confrontation against sanctions and immunizing the country’s economy against global economic crises” are the reasons why such a model should be practiced in Iran.

He further noted that the components of the resistance economy are “creating movement and dynamicity in the country’s economy and improving macroeconomic indicators”, “ability to resist against threatening factors”, “reliance on internal capacities”, adoption of a “Jihadi approach”, “people-centeredness”, “reforming consumption patterns”, “campaign against corruption” and adoption of “knowledge-based approach”.

Ayatollah Khamenei referred to the sanctions imposed by the western powers against Iran due to its peaceful nuclear program, and said the country should strengthen its economy in a way that no boycott and embargo could ever leave a negative impact on it so easily.

Iran has in the meantime urged Saudi Arabia to help stop the continuous slump in oil prices in order to protect the economies of the region’s oil producing countries, media reports said. But Saudi Arabia, the biggest oil exporter within the OPEC, has ignored Iran’s call to cut oil output and oil prices have tumbled almost 50 percent to below $50 per barrel.

“We have told Saudi Arabian officials through diplomatic channels that they should prevent the enemies of the region from harming the growing economies of the regional countries,” Iranian Deputy Foreign Minister for Arab and African Affairs Hossein Amir-Abdollahian said, reported Xinhua citing the Tasnim News agency.

Iran’s economy is heavily reliant on oil exports. Besides the losses from declining oil prices, Iran’s crude exports have fallen 60 percent to one million barrels a day due to Western sanctions on its energy and financial sectors.

Talks were held between the officials of the two countries on the sidelines of a meeting of the Organisation of Petroleum Exporting Countries (OPEC). They urged all concerned nations in the area to adopt an oil policy that benefitted the whole region, Abdollahian said.

“We expect Saudi Arabia to play a major role in (controlling) crude prices to help the regional countries,” he said.

He also said the decline in oil prices was a product of “intentional or unintentional” schemes by some countries to undermine the growing economies in the region. The Iranian President Hassan Rouhani has said some major oil producing countries, including Saudi Arabia, would suffer more than Iran in the face of declining crude prices.

According to Iran’s budget for the next year, one third of government revenues is dependent on oil sales, while more than 80 percent of Saudi Arabia and Kuwait’s annual budget rely on oil exports, Rouhani said.

Tehran is planning to lower the crude oil price in the next year’s budget to $40 a barrel, Iran’s Finance and Economic Affairs Minister Ali Tayyebnia was quoted as saying Saturday by the Tehran Times, reported Xinhua.

A flicker of hope appeared in the market during the week ending January 17, 2015 nevertheless, as prices moved a tiny nudge above the $50 per barrel mark which experts have described as “sentiment driven.”

Bloomberg News reported on Sunday, January 18 that Shares in Abu Dhabi rose to the highest level in three weeks, leading gains in Gulf Arab markets, after crude oil surged the most in more than two years. Dubai’s stocks also advanced.

The ADX General Index added 1.7 percent to close at 4,555.27, the strongest since Dec. 28. First Gulf Bank PJSC led the increase with a 2.4 percent jump. Dubai’s DFM General Index rose 1.5 percent to the highest level in almost three weeks and Qatar’s QE Index climbed 0.5 percent.

Brent, the benchmark for more than half the world’s oil, surged 5.2 percent, the most since June 2012, to $50.17 a barrel on Jan. 16. The International Energy Agency lowered its forecast for supply from non-OPEC oil producers this year. Four out of six Gulf Cooperation Council states are part of the 12-member Organization of the Petroleum Exporting Countries.

“The oil price pulled up quite nicely over the weekend, which is helping investor confidence in the regional markets,” Saleem Khokhar, who helps oversee about $3 billion at NBAD Asset Management Group, said by telephone from Abu Dhabi. “The move today is purely sentiment driven.”

Oil fell almost 50 percent last year, the most since the 2008 financial crisis, after the highest pace of U.S. production in more than three decades swelled supplies and OPEC resisted calls to cut output. The decline in crude prices sent at least six stock indexes in the GCC, home to about a third of the world’s proven oil reserves, into bear markets since November.

The valuation of Abu Dhabi’s shares rose to 11.2 times estimated 12-month earnings, compared with 10.6 for MSCI Inc.’s emerging markets index. The ADX’s 14-day relative strength index rose to 53, the highest since November. FGB rose to 17.15 dirhams. National Bank of Abu Dhabi PJSC, the United Arab Emirates’ biggest bank by assets, jumped 4.2 percent, the sharpest increase since Jan. 13.

Shares in Saudi Arabia, the world’s biggest oil exporter, climbed 0.9 percent. Saudi Basic Industries Corp., the petrochemicals maker with the second-highest weighting on the index, rose 1.5 percent even after a slide in profitability. The company reported a 29 percent drop in fourth-quarter profit to 4.36 billion riyals ($1.16 billion) as lower oil prices reduced returns [while analysts suggest the drop to be higher]. The mean estimate of seven analysts was for 5.39 billion riyals, according to data compiled by Bloomberg.

The weaker profit numbers were “widely expected by the market,” Sebastien Henin, who oversees $100 million as head of asset management at The National Investor in Abu Dhabi, said by phone. “The increase in oil prices over the weekend has lent good support to Sabic today.”

Dubai Islamic Bank PJSC, the largest Shariah-compliant lender in the U.A.E., led advancers in Dubai with a 1.4 percent increase. Arabtec Holding Co., the biggest listed construction company in the country, added 2.6 percent to 3.20 dirhams, the strongest level since Dec. 28.

Elsewhere in the region, Kuwait’s SE Price Index climbed 0.8 percent and Oman’s MSM 30 Index added 1.1 percent. Bahrain’s BB All Share Index advanced 0.4 percent. Egypt’s EGX 30 Index declined 0.3 percent, the first drop in five days. Israel’s TA-25 Index increased 0.3 percent to 1,466.94. The yield on the country’s March 2024 bonds dropped one basis point to 1.91 percent.

The Kuwait News Agency (KUNA)) has reported that some experts have predicted that the average world oil price might rebound upward in the vicinity of USD 80-85 per barrel in 2015, according to a recent economic report.

To prove that, the current dip in oil prices could push global economic growth and create higher world demand, thus sending oil prices into rebounding, said the report compiled by the Diplomatic Center for Strategic Studies.

Several OPEC member states have now realized that a cut in output in a bid to boost oil prices would necessarily result in a hike in non-OPEC production, thus losing an OPEC market share, it indicated.

The OPEC is seeking to limit oil production at a high cost margin, and though the clear-cut target is shale oil now worth USD 65-90 per barrel, long-term oil investments would be consequently affected, the report suggested.

Such investments include Russian stock development in the North Pole and deep water oilfield development in Brazil, which both require oil prices to be over USD 100 per barrel, it added.

But, the drop in oil prices had been expected due to oil oversupply at world markets whether on the part of OPEC or non-OPEC members, not to mention low global demand for oil amid international economic slowdown.

As for oil price scenarios for 2015, the report said the price could remain in the neighborhood of USD 70-75 per barrel on average in the first quarter of 2015.

Another scenario suggests that the current drop in oil prices could lead to global economic growth at rates that allow for world demand for oil to be on the increase, thus sending oil prices into a hike of USD 80-85 pb.

The last scenario is a possible rise in oil prices, provided that geopolitical problems escalate inside or outside the Middle East region, it said. In case of disruption of oil supply from Iraq, Iran, Russia and Libya, the oil price is mostly likely to hit the USD 100 mark, the report concluded.