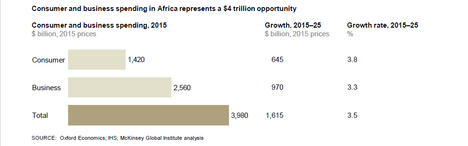

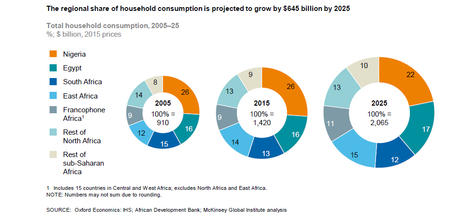

A significant driver of that growth will be surging business and consumer spending. A notable finding is that Africa’s 2015 consumer spending of $1.4tn exceeded its 2010 survey projection.

By JAKE BRIGHT, This is Africa.

Africa’s household and business spending will top $5.6tn by 2025 and its manufacturing output could reach $93bn, according to a new McKinsey & Company report.

The management consulting firm also forecasts the continent will become the world’s second fastest growing region after Asia over the next five years.

McKinsey’s Global Institute released Lions on The Move II: Realizing the potential of Africa’s economies on August 15, a sequel to its 2010 Africa survey which gained high circulation in business and policy circles.

“The original report was pivotal in getting more global firms to notice Africa’s positive economic trends,” says Atlantic Council senior Africa fellow Aubrey Hruby.

“It highlighted the continent’s market opportunities and added a lot of granularity to big sector and demographic trends that executives just could not overlook.”

Among the economic highlights, the first Lions survey emphasised an eight year average annual growth rate of 4.9 percent and that Africa’s 2008 GDP of $1.6tn-was equal to that of Brazil or Russia.

It also offered data to show this growth period was more than a commodities boom by tracking diversity in the continent’s economies, particularly Africa’s consumer markets which it projected to spend $1.4tn by 2020.

McKinsey’s 2016 Lions II report presents a positive yet more complex assessment for Africa’s aggregate economy.

On GDP, it notes the continent’s average growth fell to 3.3. percent from 2010-2015, adding that much of the emerging world experienced a slowdown over the same period due to “challenging global economic conditions”.

It also presents a pattern of divergence in the growth trajectories of the continent’s economies. Africa’s oil exporters are “experiencing sharp declines in growth, while others continue to accelerate their GDP expansion”, the authors write.

The report offers criteria to categorise African countries into two main groups–Stable Growers and Slow Growers.

Overall McKinsey concludes the continent’s outlook remains promising, highlighting that Africa’s GDP is “expanding faster than the world average”.

A significant driver of that growth will be surging business and consumer spending. A notable finding is that Africa’s 2015 consumer spending of $1.4tn exceeded its 2010 survey projection.

“The growth was much faster than expected. In Lions I the estimate was $1.38tn by 2020, but it turns out African household consumption passed that milestone in 2015,” says McKinsey’s Acha Leke, a co-author of Lions II.

The new report highlights Africa’s powerful demographics, including its young labour force and rapidly urbanising population. However, their view on employment is a mixed one.

The report found Africa’s job creation is outpacing the growth in the labour force – a major concern for policymakers keen to ensure young people find jobs. The working age population grew 2.7 percent annually from 2000-2015, while total employment grew at 2.9 percent per annum over the same period.

Lions II estimates Africa’s economies generated 21m “formal, wage paying jobs” over the last five years and that current unemployment is 8.4 percent, a drop from 10 percent in 2010.

However McKinsey’s Mr Leke emphasises they are not entirely optimistic on employment projections. “There is still this number of people in the labour force that did not get jobs plus this new number every year of people coming in” to the jobs market, he says.

“The trend is going in the right direction. But we make clear in the report there is still a need to focus big time on creating large numbers of jobs across the continent.”

One of the most direct ways to meet that job demand is through manufacturing.

The region could nearly double its manufacturing output from $500bn today to nearly $1tn by 2025 – creating 14 million stable jobs – “provided it takes decisive action to create an improved environment for manufacturers”, McKinsey argues.

One recommendation is for African firms and governments “to produce more to meet domestic demand from consumers and businesses”. McKinsey estimates three-quarters of the potential in Africa’s manufacturing sector could come from better serving domestic demand.

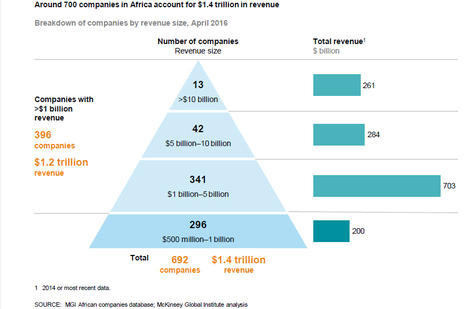

Africa now has 400 companies with revenue of more than $1bn a year, and these companies perform better than the global average, the report notes. South Africa has been an outlier for the number of large firms it has produced compared to the rest of the continent, but others are catching up.

Nevertheless “corporate Africa needs to step up its performance”, the report says, noting that even with the surge in the continent’s corporate performance, there is still not a single African company in the Fortune 500 ranking. Source: This is Africa